FixedBond

FixedBond instrument object

Description

Create and price a FixedBond instrument object for one of

more Fixed Bond instruments using this workflow:

Use

fininstrumentto create aFixedBondinstrument object for one of more Fixed Bond instruments.Use

ratecurveto specify a curve model for theFixedBondinstrument object or use aHullWhite,BlackKarasinski,BlackDermanToy,BraceGatarekMusiela,SABRBraceGatarekMusiela,CoxIngersollRoss, orLinearGaussian2Fmodel.Choose a pricing method.

When using a

ratecurveusefinpricerto specify aDiscountpricing method for one or moreFixedBondinstruments.When using a

HullWhite,BlackKarasinski,CoxIngersollRoss, orBlackDermanToymodel, usefinpricerto specify anIRTreepricing method for one or moreFixedBondinstruments.When using a

HullWhite,BlackKarasinski,BraceGatarekMusiela,SABRBraceGatarekMusiela, orLinearGaussian2Fmodel, usefinpricerto specify anIRMonteCarlopricing method for one or moreFixedBondinstruments.

For more detailed information on this workflow, see Get Started with Workflows Using Object-Based Framework for Pricing Financial Instruments.

For more information on the available models and pricing methods for a

FixedBond instrument, see Choose Instruments, Models, and Pricers.

Creation

Syntax

Description

FixedBondObj = fininstrument(InstrumentType,'CouponRate',couponrate_value,'Maturity',maturity_date)FixedBond object for one of more Fixed Bond

instruments by specifying InstrumentType and sets the

properties for the

required name-value pair arguments CouponRate and

Maturity.

The FixedBond instrument supports a vanilla bond, a

stepped coupon bond, and an amortizing bond. For more information, see More About.

FixedBondObj = fininstrument(___,Name,Value)FixedBondObj =

fininstrument("FixedBond",'CouponRate',0.34,'Maturity',datetime(2019,1,30),'Period',4,'Basis',1,'Principal',100,'FirstCouponDate',datetime(2016,1,30),'EndMonthRule',true,'Name',"fixedbond_instrument")

creates a FixedBond option with a coupon rate of 0.34 and

a maturity of January 30, 2019. You can specify multiple name-value pair

arguments.

Input Arguments

Instrument type, specified as a string with the value of

"FixedBond", a character vector with the value of

'FixedBond', an

NINST-by-1 string array with

values of "FixedBond", or an

NINST-by-1 cell array of

character vectors with values of 'FixedBond'.

Data Types: char | cell | string

Name-Value Arguments

Specify required

and optional pairs of arguments as

Name1=Value1,...,NameN=ValueN, where

Name is the argument name and Value is

the corresponding value. Name-value arguments must appear after other arguments,

but the order of the pairs does not matter.

Before R2021a, use commas to separate each name and value, and enclose

Name in quotes.

Example: FixedBondObj =

fininstrument("FixedBond",'CouponRate',0.34,'Maturity',datetime(2019,1,30),'Period',4,'Basis',1,'Principal',100,'FirstCouponDate',datetime(2016,1,30),'EndMonthRule',true,'Name',"fixedbond_instrument")

Required FixedBond Name-Value Pair Arguments

FixedBond coupon rate, specified as the

comma-separated pair consisting of 'CouponRate'

and a scalar decimal or an

NINST-by-1 vector of

decimals for an annual rate or a timetable where the first column is

dates and the second column is associated rates. The date indicates

the last day that the coupon rate is valid.

Note

If you are creating one or more FixedBond

instruments and use a timetable, the timetable specification

applies to all of the FixedBond instruments.

CouponRate does not accept an

NINST-by-1 cell array

of timetables as input.

Data Types: double | timetable

FixedBond maturity date, specified as the

comma-separated pair consisting of 'Maturity' and

a scalar or an NINST-by-1

vector using a datetime array, string array, or date character

vectors.

To support existing code, FixedBond also

accepts serial date numbers as inputs, but they are not recommended.

If you use date character vectors or strings, the format must be

recognizable by datetime because

the Maturity property is stored as a

datetime.

Optional FixedBond Name-Value Pair Arguments

Frequency of payments, specified as the comma-separated pair

consisting of 'Period' and a scalar integer or an

NINST-by-1 vector of

integers. Values for Period are

1, 2,

3, 4, 6, or

12.

Data Types: double

Day count basis, specified as the comma-separated pair consisting

of 'Basis' and scalar integer or an

NINST-by-1 vector of

integers using the following values:

0 — actual/actual

1 — 30/360 (SIA)

2 — actual/360

3 — actual/365

4 — 30/360 (PSA)

5 — 30/360 (ISDA)

6 — 30/360 (European)

7 — actual/365 (Japanese)

8 — actual/actual (ICMA)

9 — actual/360 (ICMA)

10 — actual/365 (ICMA)

11 — 30/360E (ICMA)

12 — actual/365 (ISDA)

13 — BUS/252

For more information, see Basis.

Data Types: double

Principal amount or principal value schedule, specified as the

comma-separated pair consisting of 'Principal'

and a scalar numeric or an

NINST-by-1 numeric vector

or a timetable.

Principal accepts a timetable, where the

first column is dates and the second column is the associated

notional principal value. The date indicates the last day that the

principal value is valid.

Note

If you are creating one or more FixedBond

instruments and use a timetable, the timetable specification

applies to all of the FixedBond instruments.

Principal does not accept an

NINST-by-1 cell array

of timetables as input.

Data Types: double | timetable

Flag indicating whether cash flow is adjusted by day count

convention, specified as the comma-separated pair consisting of

'DaycountAdjustedCashFlow' and a scalar

logical or an NINST-by-1

vector of logicals with values of true or

false.

Data Types: logical

Business day conventions for cash flow dates, specified as the

comma-separated pair consisting of

'BusinessDayConvention' and a scalar string

or character vector or an

NINST-by-1 cell array of

character vectors or string array. The selection for business day

convention determines how nonbusiness days are treated. Nonbusiness

days are defined as weekends plus any other date that businesses are

not open (for example, statutory holidays). Values are:

"actual"— Nonbusiness days are effectively ignored. Cash flows that fall on nonbusiness days are assumed to be distributed on the actual date."follow"— Cash flows that fall on a nonbusiness day are assumed to be distributed on the following business day."modifiedfollow"— Cash flows that fall on a nonbusiness day are assumed to be distributed on the following business day. However, if the following business day is in a different month, the previous business day is adopted instead."previous"— Cash flows that fall on a nonbusiness day are assumed to be distributed on the previous business day."modifiedprevious"— Cash flows that fall on a nonbusiness day are assumed to be distributed on the previous business day. However, if the previous business day is in a different month, the following business day is adopted instead.

Data Types: char | cell | string

Holidays used in computing business days, specified as the

comma-separated pair consisting of 'Holidays' and

dates using an NINST-by-1

vector of a datetime array, string array, or date character vectors.

For

example:

H = holidays(datetime('today'),datetime(2025,12,15)); FixedBondObj = fininstrument("FixedBond",'CouponRate',0.34,'Maturity',datetime(2025,12,15),'Holidays',H)

To support existing code, FixedBond also

accepts serial date numbers as inputs, but they are not recommended.

End-of-month rule flag for generating dates when

Maturity is an end-of-month date for a month

with 30 or fewer days, specified as the comma-separated pair

consisting of 'EndMonthRule' and a scalar logical

value or an NINST-by-1 vector

of logicals with values of true or

false.

If you set

EndMonthRuletofalse, the software ignores the rule, meaning that a payment date is always the same numerical day of the month.If you set

EndMonthRuletotrue, the software sets the rule on, meaning that a payment date is always the last actual day of the month.

Data Types: logical

Bond issue date, specified as the comma-separated pair consisting

of 'IssueDate' and a scalar or an

NINST-by-1 vector using a

datetime array, string array, or date character vectors.

To support existing code, FixedBond also

accepts serial date numbers as inputs, but they are not recommended.

If you use date character vectors or strings, the format must be

recognizable by datetime because

the IssueDate property is stored as a

datetime.

Irregular first coupon date, specified as the comma-separated pair

consisting of 'FirstCouponDate' and a scalar or

an NINST-by-1 vector using a

datetime array, string array, or date character vectors.

To support existing code, FixedBond also

accepts serial date numbers as inputs, but they are not recommended.

When FirstCouponDate and

LastCouponDate are both specified,

FirstCouponDate takes precedence in

determining the coupon payment structure. If you do not specify

FirstCouponDate, the cash flow payment dates

are determined from other inputs.

If you use date character vectors or strings, the format must be

recognizable by datetime because

the FirstCouponDate property is stored as a

datetime.

Irregular last coupon date, specified as the comma-separated pair

consisting of 'LastCouponDate' and a scalar or an

NINST-by-1 vector using a

datetime array, string array, or date character vectors.

To support existing code, FixedBond also

accepts serial date numbers as inputs, but they are not recommended.

If you specify LastCouponDate but not

FirstCouponDate,

LastCouponDate determines the coupon

structure of the bond. The coupon structure of a bond is truncated

at LastCouponDate, regardless of where it falls,

and is followed only by the bond's maturity cash flow date. If you

do not specify LastCouponDate, the cash flow

payment dates are determined from other inputs.

If you use date character vectors or strings, the format must be

recognizable by datetime because

the LastCouponDate property is stored as a

datetime.

Forward starting date of payments, specified as the

comma-separated pair consisting of 'StartDate'

and a scalar or an NINST-by-1

vector using a datetime array, string array, or date character

vectors.

To support existing code, FixedBond also

accepts serial date numbers as inputs, but they are not recommended.

If you use date character vectors or strings, the format must be

recognizable by datetime because

the StartDate property is stored as a

datetime.

User-defined name for one of more instruments, specified as the

comma-separated pair consisting of 'Name' and a

scalar string or character vector or an

NINST-by-1 cell array of

character vectors or string array.

Data Types: char | cell | string

Output Arguments

Fixed Bond instrument, returned as a FixedBond

object.

Properties

FixedBond coupon annual rate, returned as a scalar

decimal or an NINST-by-1 vector of

decimals or a timetable.

Data Types: double | timetable

FixedBond maturity date, returned as a scalar datetime

or NINST-by-1 vector of

datetimes.

Data Types: datetime

Frequency of payments per year, returned as a scalar integer or an

NINST-by-1 vector of

integers.

Data Types: double

Day count basis, returned as a scalar integer or an

NINST-by-1 vector of integers.

Data Types: double

Principal amount or principal value schedules, returned as a scalar

numeric or an NINST-by-1 numeric

vector or a timetable.

Data Types: double

Flag indicating whether cash flow adjusts for day count convention,

returned as scalar logical or an

NINST-by-1 vector of logicals with

values of true or false.

Data Types: logical

Business day conventions, returned as a scalar string or an

NINST-by-1 string array.

Data Types: string

Holidays used in computing business days, returned as an

NINST-by-1 vector of

datetimes.

Data Types: datetime

End-of-month rule flag for generating dates when

Maturity is an end-of-month date for a month having

30 or fewer days, returned as a scalar logical or an

NINST-by-1 vector of logical

values.

Data Types: logical

Bond issue date, returned as a scalar datetime or an

NINST-by-1 vector of

datetimes.

Data Types: datetime

Irregular first coupon date, returned as a scalar datetime or an

NINST-by-1 vector of datetimes.

Data Types: datetime

Irregular last coupon date, returned as a scalar datetime or an

NINST-by-1 vector of

datetimes.

Data Types: datetime

Forward starting date of payments, returned as a scalar datetime or an

NINST-by-1 vector of datetimes.

Data Types: datetime

User-defined name for the instrument, returned as a scalar string or an

NINST-by-1 string array.

Data Types: string

Object Functions

cashflows | Compute cash flow for FixedBond, FloatBond,

Swap, FRA, STIRFuture,

OISFuture, OvernightIndexedSwap, or

Deposit instrument |

Examples

This example shows the workflow to price a vanilla FixedBond instrument when you use a ratecurve and a Discount pricing method.

Create FixedBond Instrument Object

Use fininstrument to create a FixedBond instrument object.

FixB = fininstrument("FixedBond",'Maturity',datetime(2022,9,15),'CouponRate',0.021,'Period',2,'Basis',1,'Principal',100,'Name',"fixed_bond_instrument")

FixB =

FixedBond with properties:

CouponRate: 0.0210

Period: 2

Basis: 1

EndMonthRule: 1

Principal: 100

DaycountAdjustedCashFlow: 0

BusinessDayConvention: "actual"

Holidays: NaT

IssueDate: NaT

FirstCouponDate: NaT

LastCouponDate: NaT

StartDate: NaT

Maturity: 15-Sep-2022

Name: "fixed_bond_instrument"

Create ratecurve Object

Create a ratecurve object using ratecurve.

Settle = datetime(2018,9,15); Type = 'zero'; ZeroTimes = [calmonths(6) calyears([1 2 3 4 5 7 10 20 30])]'; ZeroRates = [0.0052 0.0055 0.0061 0.0073 0.0094 0.0119 0.0168 0.0222 0.0293 0.0307]'; ZeroDates = Settle + ZeroTimes; myRC = ratecurve('zero',Settle,ZeroDates,ZeroRates)

myRC =

ratecurve with properties:

Type: "zero"

Compounding: -1

Basis: 0

Dates: [10×1 datetime]

Rates: [10×1 double]

Settle: 15-Sep-2018

InterpMethod: "linear"

ShortExtrapMethod: "next"

LongExtrapMethod: "previous"

Create Discount Pricer Object

Use finpricer to create a Discount pricer object and use the ratecurve object with the 'DiscountCurve' name-value pair argument.

outPricer = finpricer("Discount",'DiscountCurve',myRC)

outPricer =

Discount with properties:

DiscountCurve: [1×1 ratecurve]

Price FixedBond Instrument

Use price to compute the price and sensitivities for the FixedBond instrument.

[Price, outPR] = price(outPricer, FixB,["all"])Price = 104.5679

outPR =

priceresult with properties:

Results: [1×2 table]

PricerData: []

outPR.Results

ans=1×2 table

Price DV01

______ ________

104.57 0.040397

This example shows how to create a FixedBond instrument and then use any of the following Financial Toolbox™ functions to perform bond analytics: bnddurp, bnddury, bndconvp, bndconvy, bndkrdur, cfdur, and cfconv.

Create FixedBond Instrument Object

Use fininstrument to create a FixedBond instrument object.

MaturityDate = datetime(2027,12,16); CouponRate = 0.01; FixedBondObj = fininstrument('FixedBond','CouponRate',CouponRate,'Maturity',MaturityDate);

Create ratecurve Object

Create a ratecurve object using ratecurve.

Settle = datetime(2022,10,10);

MarketDates = datetime([2023,9,15 ; 2024,9,15 ; 2025,9,15 ; 2026,9,15 ; 2027,9,15 ; 2028,9,15]);

ZeroDates = datetime([2023,10,15 ; 2024,10,15 ; 2025,10,15 ; 2026,10,15 ; 2027,10,15 ; 2028,10,15]);

ZeroRates = [4.2520 4.1081 3.8801 3.7170 3.6060 3.5250]'/100;

MarketSpreads = [97.9825 97.9825 97.9825 97.9825 97.9825 97.9825]';

RateObjB = ratecurve('zero',Settle,ZeroDates,ZeroRates+MarketSpreads(1)/10000); Create Discount Pricer Object

Use finpricer to create a Discount pricer object and use the ratecurve object with the 'DiscountCurve' name-value argument.

Pricer1 = finpricer("Discount",'DiscountCurve',RateObjB);

Price FixedBond Instrument

Use price to compute the price and sensitivities for the FixedBond instrument.

[Price1, outPR] = price(Pricer1, FixedBondObj,["all"])Price1 = 83.4210

outPR =

priceresult with properties:

Results: [1×2 table]

PricerData: []

Compute Bond Durations for FixedBond Instrument

Use bnddurp to compute the bond durations given the bond price.

[ModDuration, YearDuration, PerDuration] = bnddurp(Price1,FixedBondObj.CouponRate, Settle, FixedBondObj.Maturity,Period=FixedBondObj.Period)

ModDuration = 4.9169

YearDuration = 5.0308

PerDuration = 10.0616

Compute Key Rate Durations for FixedBond Instrument

Use bndkrdur to compute the FixedBond instrument key rate duration given a zero curve.

ZeroData1 = [datenum(RateObjB.Dates) RateObjB.Rates]; KeyRateDuration = bndkrdur(ZeroData1,FixedBondObj.CouponRate,Settle,FixedBondObj.Maturity)

KeyRateDuration = 1×6

0.0133 0.0212 0.0304 0.0389 4.0226 0.8164

This example shows the workflow to price multiple vanilla FixedBond instruments when you use a ratecurve and a Discount pricing method.

Create FixedBond Instrument Object

Use fininstrument to create a FixedBond instrument object for three Fixed Bond instruments.

FixB = fininstrument("FixedBond",'Maturity',datetime([2022,9,15 ; 2022,10,15 ; 2022,11,15]),'CouponRate',0.021,'Period',2,'Basis',1,'Principal',[100 ; 250 ; 500],'Name',"fixed_bond_instrument")

FixB=3×1 FixedBond array with properties:

CouponRate

Period

Basis

EndMonthRule

Principal

DaycountAdjustedCashFlow

BusinessDayConvention

Holidays

IssueDate

FirstCouponDate

LastCouponDate

StartDate

Maturity

Name

Create ratecurve Object

Create a ratecurve object using ratecurve.

Settle = datetime(2018,9,15); Type = 'zero'; ZeroTimes = [calmonths(6) calyears([1 2 3 4 5 7 10 20 30])]'; ZeroRates = [0.0052 0.0055 0.0061 0.0073 0.0094 0.0119 0.0168 0.0222 0.0293 0.0307]'; ZeroDates = Settle + ZeroTimes; myRC = ratecurve('zero',Settle,ZeroDates,ZeroRates)

myRC =

ratecurve with properties:

Type: "zero"

Compounding: -1

Basis: 0

Dates: [10×1 datetime]

Rates: [10×1 double]

Settle: 15-Sep-2018

InterpMethod: "linear"

ShortExtrapMethod: "next"

LongExtrapMethod: "previous"

Create Discount Pricer Object

Use finpricer to create a Discount pricer object and use the ratecurve object with the 'DiscountCurve' name-value pair argument.

outPricer = finpricer("Discount",'DiscountCurve',myRC)

outPricer =

Discount with properties:

DiscountCurve: [1×1 ratecurve]

Price FixedBond Instruments

Use price to compute the prices and sensitivities for the FixedBond instruments.

[Price, outPR] = price(outPricer, FixB,["all"])Price = 3×1

104.5679

261.4498

522.9174

outPR=1×3 priceresult array with properties:

Results

PricerData

outPR.Results

ans=1×2 table

Price DV01

______ ________

104.57 0.040397

ans=1×2 table

Price DV01

______ _____

261.45 0.103

ans=1×2 table

Price DV01

______ _______

522.92 0.21013

This example shows the workflow to price a stepped FixedBond instrument when you use a ratecurve and a Discount pricing method.

Create FixedBond Instrument Object

Use fininstrument to create a stepped FixedBond instrument object.

Maturity = datetime(2024,1,1); Period = 1; CDates = datetime([2020,1,1 ; 2024,1,1]); CRates = [.025; .03]; CouponRate = timetable(CDates,CRates); SBond = fininstrument("FixedBond",'Maturity',Maturity,'CouponRate',CouponRate,'Period',Period)

SBond =

FixedBond with properties:

CouponRate: [2×1 timetable]

Period: 1

Basis: 0

EndMonthRule: 1

Principal: 100

DaycountAdjustedCashFlow: 0

BusinessDayConvention: "actual"

Holidays: NaT

IssueDate: NaT

FirstCouponDate: NaT

LastCouponDate: NaT

StartDate: NaT

Maturity: 01-Jan-2024

Name: ""

Create ratecurve Object

Create a ratecurve object using ratecurve.

Settle = datetime(2018,1,1); ZeroTimes = calyears(1:10)'; ZeroRates = [0.0052 0.0055 0.0061 0.0073 0.0094 0.0119 0.0168 0.0222 0.0293 0.0307]'; ZeroDates = Settle + ZeroTimes; Compounding = 1; ZeroCurve = ratecurve("zero",Settle,ZeroDates,ZeroRates, "Compounding",Compounding)

ZeroCurve =

ratecurve with properties:

Type: "zero"

Compounding: 1

Basis: 0

Dates: [10×1 datetime]

Rates: [10×1 double]

Settle: 01-Jan-2018

InterpMethod: "linear"

ShortExtrapMethod: "next"

LongExtrapMethod: "previous"

Create Discount Pricer Object

Use finpricer to create a Discount pricer object and use the ratecurve object with the 'DiscountCurve' name-value pair argument.

outPricer = finpricer("Discount",'DiscountCurve',ZeroCurve)

outPricer =

Discount with properties:

DiscountCurve: [1×1 ratecurve]

Price FixedBond Instrument

Use price to compute the price and sensitivities for the vanilla FixedBond instrument.

[Price, outPR] = price(outPricer, SBond,["all"])Price = 109.6218

outPR =

priceresult with properties:

Results: [1×2 table]

PricerData: []

outPR.Results

ans=1×2 table

Price DV01

______ ________

109.62 0.061108

This example shows the workflow to price an amortizing FixedBond instrument when you use a ratecurve and a Discount pricing method.

Create FixedBond Instrument Object

Use fininstrument to create an amortizing FixedBond instrument object.

Maturity = datetime(2024,1,1); Period = 1; ADates = datetime([2020,1,1 ; 2024,1,1]); APrincipal = [100; 85]; Principal = timetable(ADates,APrincipal); Bondamort = fininstrument("FixedBond",'Maturity',Maturity,'CouponRate',0.025,'Period',Period,'Principal',Principal)

Bondamort =

FixedBond with properties:

CouponRate: 0.0250

Period: 1

Basis: 0

EndMonthRule: 1

Principal: [2×1 timetable]

DaycountAdjustedCashFlow: 0

BusinessDayConvention: "actual"

Holidays: NaT

IssueDate: NaT

FirstCouponDate: NaT

LastCouponDate: NaT

StartDate: NaT

Maturity: 01-Jan-2024

Name: ""

Create ratecurve Object

Create a ratecurve object using ratecurve.

Settle = datetime(2018,1,1); ZeroTimes = calyears(1:10)'; ZeroRates = [0.0052 0.0055 0.0061 0.0073 0.0094 0.0119 0.0168 0.0222 0.0293 0.0307]'; ZeroDates = Settle + ZeroTimes; Compounding = 1; ZeroCurve = ratecurve("zero",Settle,ZeroDates,ZeroRates, "Compounding",Compounding);

Create Discount Pricer Object

Use finpricer to create a Discount pricer object and use the ratecurve object for the 'DiscountCurve' name-value pair argument.

outPricer = finpricer("Discount",'DiscountCurve',ZeroCurve)

outPricer =

Discount with properties:

DiscountCurve: [1×1 ratecurve]

Price FixedBond Instrument

Use price to compute the price and sensitivities for the vanilla FixedBond instrument.

[Price, outPR] = price(outPricer,Bondamort,["all"])Price = 107.1273

outPR =

priceresult with properties:

Results: [1×2 table]

PricerData: []

outPR.Results

ans=1×2 table

Price DV01

______ ________

107.13 0.054279

This example shows the workflow to price a FixedBond instrument when using a HullWhite model and an IRMonteCarlo pricing method.

Create FixedBond Instrument Object

Use fininstrument to create a FixedBond instrument object.

FixB = fininstrument("FixedBond","Maturity",datetime(2022,9,15),"CouponRate",0.05,'Name',"fixed_bond")

FixB =

FixedBond with properties:

CouponRate: 0.0500

Period: 2

Basis: 0

EndMonthRule: 1

Principal: 100

DaycountAdjustedCashFlow: 0

BusinessDayConvention: "actual"

Holidays: NaT

IssueDate: NaT

FirstCouponDate: NaT

LastCouponDate: NaT

StartDate: NaT

Maturity: 15-Sep-2022

Name: "fixed_bond"

Create HullWhite Model Object

Use finmodel to create a HullWhite model object.

HullWhiteModel = finmodel("HullWhite",'Alpha',0.32,'Sigma',0.49)

HullWhiteModel =

HullWhite with properties:

Alpha: 0.3200

Sigma: 0.4900

Create ratecurve Object

Create a ratecurve object using ratecurve.

Settle = datetime(2019,1,1); Type = 'zero'; ZeroTimes = [calmonths(6) calyears([1 2 3 4 5 7 10 20 30])]'; ZeroRates = [0.0052 0.0055 0.0061 0.0073 0.0094 0.0119 0.0168 0.0222 0.0293 0.0307]'; ZeroDates = Settle + ZeroTimes; myRC = ratecurve('zero',Settle,ZeroDates,ZeroRates)

myRC =

ratecurve with properties:

Type: "zero"

Compounding: -1

Basis: 0

Dates: [10×1 datetime]

Rates: [10×1 double]

Settle: 01-Jan-2019

InterpMethod: "linear"

ShortExtrapMethod: "next"

LongExtrapMethod: "previous"

Create IRMonteCarlo Pricer Object

Use finpricer to create an IRMonteCarlo pricer object and use the ratecurve object for the 'DiscountCurve' name-value pair argument.

outPricer = finpricer("IRMonteCarlo",'Model',HullWhiteModel,'DiscountCurve',myRC,'SimulationDates',ZeroDates)

outPricer =

HWMonteCarlo with properties:

NumTrials: 1000

RandomNumbers: []

DiscountCurve: [1×1 ratecurve]

SimulationDates: [01-Jul-2019 01-Jan-2020 01-Jan-2021 01-Jan-2022 01-Jan-2023 01-Jan-2024 01-Jan-2026 01-Jan-2029 01-Jan-2039 01-Jan-2049]

Model: [1×1 finmodel.HullWhite]

Price FixedBond Instrument

Use price to compute the price and sensitivities for the FixedBond instrument.

[Price,outPR] = price(outPricer,FixB,["all"])Price = 115.0303

outPR =

priceresult with properties:

Results: [1×4 table]

PricerData: [1×1 struct]

outPR.Results

ans=1×4 table

Price Delta Gamma Vega

______ _______ ______ ____

115.03 -397.13 1430.4 0

This example shows the workflow to price a FixedBond instrument when using a HullWhite model and a IRTree pricing method.

Create FixedBond Instrument Object

Use fininstrument to create a FixedBond instrument object.

FixB = fininstrument("FixedBond","Maturity",datetime(2029,9,15),"CouponRate",.05,"Period",1,"Name","fixed_bond_instrument")

FixB =

FixedBond with properties:

CouponRate: 0.0500

Period: 1

Basis: 0

EndMonthRule: 1

Principal: 100

DaycountAdjustedCashFlow: 0

BusinessDayConvention: "actual"

Holidays: NaT

IssueDate: NaT

FirstCouponDate: NaT

LastCouponDate: NaT

StartDate: NaT

Maturity: 15-Sep-2029

Name: "fixed_bond_instrument"

Create ratecurve Object

Create a ratecurve object using ratecurve.

Settle = datetime(2019,9,15); Type = "zero"; ZeroTimes = [calyears([1:10])]'; ZeroRates = [0.0055 0.0061 0.0073 0.0094 0.0119 0.0168 0.0222 0.0293 0.0307 0.0310]'; ZeroDates = Settle + ZeroTimes; myRC = ratecurve('zero',Settle,ZeroDates,ZeroRates)

myRC =

ratecurve with properties:

Type: "zero"

Compounding: -1

Basis: 0

Dates: [10×1 datetime]

Rates: [10×1 double]

Settle: 15-Sep-2019

InterpMethod: "linear"

ShortExtrapMethod: "next"

LongExtrapMethod: "previous"

Create HullWhite Model Object

Use finmodel to create a HullWhite model object.

HullWhiteModel = finmodel("hullwhite",'Alpha',0.052,'Sigma',0.34)

HullWhiteModel =

HullWhite with properties:

Alpha: 0.0520

Sigma: 0.3400

Create IRTree Pricer Object

Use finpricer to create an IRTree pricer object and use the ratecurve object with the 'DiscountCurve' name-value pair argument.

HWTreePricer = finpricer("irtree","model",HullWhiteModel,"DiscountCurve",myRC,"TreeDates",ZeroDates)

HWTreePricer =

HWBKTree with properties:

Tree: [1×1 struct]

TreeDates: [10×1 datetime]

Model: [1×1 finmodel.HullWhite]

DiscountCurve: [1×1 ratecurve]

HWTreePricer.Tree

ans = struct with fields:

tObs: [0 1 1.9973 2.9945 3.9918 4.9918 5.9891 6.9863 7.9836 8.9836]

dObs: [15-Sep-2019 15-Sep-2020 15-Sep-2021 15-Sep-2022 15-Sep-2023 15-Sep-2024 15-Sep-2025 15-Sep-2026 15-Sep-2027 15-Sep-2028]

CFlowT: {[10×1 double] [9×1 double] [8×1 double] [7×1 double] [6×1 double] [5×1 double] [4×1 double] [3×1 double] [2×1 double] [9.9809]}

Probs: {[3×1 double] [3×3 double] [3×5 double] [3×7 double] [3×9 double] [3×11 double] [3×13 double] [3×15 double] [3×17 double]}

Connect: {[2] [2 3 4] [2 3 4 5 6] [2 3 4 5 6 7 8] [2 3 4 5 6 7 8 9 10] [2 3 4 5 6 7 8 9 10 11 12] [2 3 4 5 6 7 8 9 10 11 12 13 14] [2 3 4 5 6 7 8 9 10 11 12 13 14 15 16] [2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18]}

FwdTree: {1×10 cell}

RateTree: {1×10 cell}

Price FixedBond Instrument

Use price to compute the price and sensitivities for the FixedBond instrument.

[Price, outPR] = price(HWTreePricer, FixB,["all"])Price = 117.9440

outPR =

priceresult with properties:

Results: [1×4 table]

PricerData: [1×1 struct]

outPR.Results

ans=1×4 table

Price Delta Gamma Vega

______ _______ ______ ___________

117.94 -964.01 8868.6 -4.2633e-10

This example shows the workflow to price a FixedBond instrument when you use a CoxIngersollRoss model and an IRTree pricing method.

Create FixedBond Instrument Object

Use fininstrument to create a FixedBond instrument object.

Period = 1; Maturity = datetime(2027,1,1); CouponRate = 0.035; FixedBond = fininstrument("FixedBond",'Maturity',Maturity,'CouponRate',CouponRate,'Period',Period,Name="fixed_bond")

FixedBond =

FixedBond with properties:

CouponRate: 0.0350

Period: 1

Basis: 0

EndMonthRule: 1

Principal: 100

DaycountAdjustedCashFlow: 0

BusinessDayConvention: "actual"

Holidays: NaT

IssueDate: NaT

FirstCouponDate: NaT

LastCouponDate: NaT

StartDate: NaT

Maturity: 01-Jan-2027

Name: "fixed_bond"

Create CoxIngersollRoss Model Object

Use finmodel to create a CoxIngersollRoss model object.

alpha = 0.03;

theta = 0.02;

sigma = 0.1;

CIRModel = finmodel("CoxIngersollRoss",Sigma=sigma,Alpha=alpha,Theta=theta)CIRModel =

CoxIngersollRoss with properties:

Sigma: 0.1000

Alpha: 0.0300

Theta: 0.0200

Create ratecurve Object

Create a ratecurve object using ratecurve.

Times= [calyears([1 2 3 4 ])]';

Settle = datetime(2023,1,1);

ZRates = [0.035; 0.042147; 0.047345; 0.052707]';

ZDates = Settle + Times;

Compounding = -1;

Basis = 1;

ZeroCurve = ratecurve("zero",Settle,ZDates,ZRates,Compounding = Compounding, Basis = Basis);Create IRTree Pricer Object

Use finpricer to create an IRTree pricer object for the CoxIngersollRoss model and use the ratecurve object for the 'DiscountCurve' name-value argument.

CIRPricer = finpricer("irtree",Model=CIRModel,DiscountCurve=ZeroCurve,Maturity=ZDates(end),NumPeriods=length(ZDates))CIRPricer =

CIRTree with properties:

Tree: [1×1 struct]

TreeDates: [4×1 datetime]

Model: [1×1 finmodel.CoxIngersollRoss]

DiscountCurve: [1×1 ratecurve]

Price FixedBond Instrument

Use price to compute the price for the FixedBond instrument.

[Price,outPR] = price(CIRPricer,FixedBond,"all")Price = 93.4593

outPR =

priceresult with properties:

Results: [1×4 table]

PricerData: [1×1 struct]

outPR.Results

ans=1×4 table

Price Delta Gamma Vega

______ _______ ______ ___________

93.459 -354.23 1384.8 -1.4211e-10

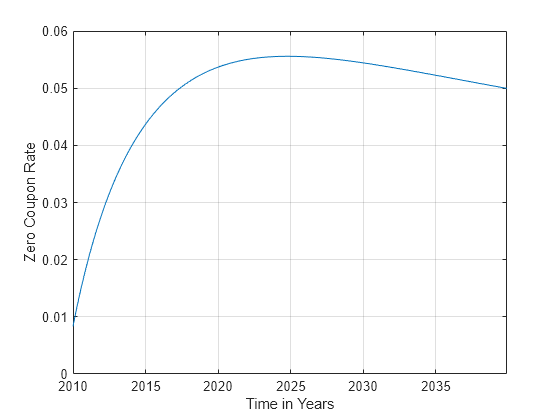

This example shows the workflow for using FixedBond instruments that are fit to a Svensson model using fitSvensson.

Define the bond data and use fininstrument to create FixedBond instrument objects.

settle = datetime(2009,11,24)

settle = datetime

24-Nov-2009

maturity = settle + calyears([1;2;3;5;7;10;20;30])

maturity = 8×1 datetime

24-Nov-2010

24-Nov-2011

24-Nov-2012

24-Nov-2014

24-Nov-2016

24-Nov-2019

24-Nov-2029

24-Nov-2039

price = [100.1; 100.1; 100.2; 99.0; ... 100.8; 99.2; 101.7; 100.2]; coupon = [0.020; 0.0275; 0.035; 0.042; ... 0.0475; 0.0525; 0.055; 0.052]; Bonds = fininstrument("FixedBond",'Maturity',maturity,'CouponRate',coupon)

Bonds=8×1 FixedBond array with properties:

CouponRate

Period

Basis

EndMonthRule

Principal

DaycountAdjustedCashFlow

BusinessDayConvention

Holidays

IssueDate

FirstCouponDate

LastCouponDate

StartDate

Maturity

Name

Use fitSvensson to create a parameter curve object.

lb = [-Inf -Inf -Inf -Inf 0 0]; ub = [Inf Inf Inf Inf 5 20]; x0 = [.5 .5 .5 .5 2 5]; SvenModel = fitSvensson(settle,Bonds,price,'x0',x0,'lb',lb,'ub',ub)

Local minimum possible. lsqnonlin stopped because the final change in the sum of squares relative to its initial value is less than the value of the function tolerance. <stopping criteria details>

SvenModel =

parametercurve with properties:

Type: "zero"

Settle: 24-Nov-2009

Compounding: -1

Basis: 0

FunctionHandle: @(t)fitF(Params,t)

Parameters: [0.0290 -0.0217 0.0025 0.0973 1.7800 7.5294]

p = SvenModel.Parameters

p = 1×6

0.0290 -0.0217 0.0025 0.0973 1.7800 7.5294

maturities = settle(1) + calmonths(1:360)

maturities = 1×360 datetime

24-Dec-2009 24-Jan-2010 24-Feb-2010 24-Mar-2010 24-Apr-2010 24-May-2010 24-Jun-2010 24-Jul-2010 24-Aug-2010 24-Sep-2010 24-Oct-2010 24-Nov-2010 24-Dec-2010 24-Jan-2011 24-Feb-2011 24-Mar-2011 24-Apr-2011 24-May-2011 24-Jun-2011 24-Jul-2011 24-Aug-2011 24-Sep-2011 24-Oct-2011 24-Nov-2011 24-Dec-2011 24-Jan-2012 24-Feb-2012 24-Mar-2012 24-Apr-2012 24-May-2012 24-Jun-2012 24-Jul-2012 24-Aug-2012 24-Sep-2012 24-Oct-2012 24-Nov-2012 24-Dec-2012 24-Jan-2013 24-Feb-2013 24-Mar-2013 24-Apr-2013 24-May-2013 24-Jun-2013 24-Jul-2013 24-Aug-2013 24-Sep-2013 24-Oct-2013 24-Nov-2013 24-Dec-2013 24-Jan-2014 24-Feb-2014 24-Mar-2014 24-Apr-2014 24-May-2014 24-Jun-2014 24-Jul-2014 24-Aug-2014 24-Sep-2014 24-Oct-2014 24-Nov-2014 24-Dec-2014 24-Jan-2015 24-Feb-2015 24-Mar-2015 24-Apr-2015 24-May-2015 24-Jun-2015 24-Jul-2015 24-Aug-2015 24-Sep-2015 24-Oct-2015 24-Nov-2015 24-Dec-2015 24-Jan-2016 24-Feb-2016 24-Mar-2016 24-Apr-2016 24-May-2016 24-Jun-2016 24-Jul-2016 24-Aug-2016 24-Sep-2016 24-Oct-2016 24-Nov-2016 24-Dec-2016 24-Jan-2017 24-Feb-2017 24-Mar-2017 24-Apr-2017 24-May-2017 24-Jun-2017 24-Jul-2017 24-Aug-2017 24-Sep-2017 24-Oct-2017 24-Nov-2017 24-Dec-2017 24-Jan-2018 24-Feb-2018 24-Mar-2018 24-Apr-2018 24-May-2018 24-Jun-2018 24-Jul-2018 24-Aug-2018 24-Sep-2018 24-Oct-2018 24-Nov-2018 24-Dec-2018 24-Jan-2019 24-Feb-2019 24-Mar-2019 24-Apr-2019 24-May-2019 24-Jun-2019 24-Jul-2019 24-Aug-2019 24-Sep-2019 24-Oct-2019 24-Nov-2019 24-Dec-2019 24-Jan-2020 24-Feb-2020 24-Mar-2020 24-Apr-2020 24-May-2020 24-Jun-2020 24-Jul-2020 24-Aug-2020 24-Sep-2020 24-Oct-2020 24-Nov-2020 24-Dec-2020 24-Jan-2021 24-Feb-2021 24-Mar-2021 24-Apr-2021 24-May-2021 24-Jun-2021 24-Jul-2021 24-Aug-2021 24-Sep-2021 24-Oct-2021 24-Nov-2021 24-Dec-2021 24-Jan-2022 24-Feb-2022 24-Mar-2022 24-Apr-2022 24-May-2022 24-Jun-2022 24-Jul-2022 24-Aug-2022 24-Sep-2022 24-Oct-2022 24-Nov-2022 24-Dec-2022 24-Jan-2023 24-Feb-2023 24-Mar-2023 24-Apr-2023 24-May-2023 24-Jun-2023 24-Jul-2023 24-Aug-2023 24-Sep-2023 24-Oct-2023 24-Nov-2023 24-Dec-2023 24-Jan-2024 24-Feb-2024 24-Mar-2024 24-Apr-2024 24-May-2024 24-Jun-2024 24-Jul-2024 24-Aug-2024 24-Sep-2024 24-Oct-2024 24-Nov-2024 24-Dec-2024 24-Jan-2025 24-Feb-2025 24-Mar-2025 24-Apr-2025 24-May-2025 24-Jun-2025 24-Jul-2025 24-Aug-2025 24-Sep-2025 24-Oct-2025 24-Nov-2025 24-Dec-2025 24-Jan-2026 24-Feb-2026 24-Mar-2026 24-Apr-2026 24-May-2026 24-Jun-2026 24-Jul-2026 24-Aug-2026 24-Sep-2026 24-Oct-2026 24-Nov-2026 24-Dec-2026 24-Jan-2027 24-Feb-2027 24-Mar-2027 24-Apr-2027 24-May-2027 24-Jun-2027 24-Jul-2027 24-Aug-2027 24-Sep-2027 24-Oct-2027 24-Nov-2027 24-Dec-2027 24-Jan-2028 24-Feb-2028 24-Mar-2028 24-Apr-2028 24-May-2028 24-Jun-2028 24-Jul-2028 24-Aug-2028 24-Sep-2028 24-Oct-2028 24-Nov-2028 24-Dec-2028 24-Jan-2029 24-Feb-2029 24-Mar-2029 24-Apr-2029 24-May-2029 24-Jun-2029 24-Jul-2029 24-Aug-2029 24-Sep-2029 24-Oct-2029 24-Nov-2029 24-Dec-2029 24-Jan-2030 24-Feb-2030 24-Mar-2030 24-Apr-2030 24-May-2030 24-Jun-2030 24-Jul-2030 24-Aug-2030 24-Sep-2030 24-Oct-2030 24-Nov-2030 24-Dec-2030 24-Jan-2031 24-Feb-2031 24-Mar-2031 24-Apr-2031 24-May-2031 24-Jun-2031 24-Jul-2031 24-Aug-2031 24-Sep-2031 24-Oct-2031 24-Nov-2031 24-Dec-2031 24-Jan-2032 24-Feb-2032 24-Mar-2032 24-Apr-2032 24-May-2032 24-Jun-2032 24-Jul-2032 24-Aug-2032 24-Sep-2032 24-Oct-2032 24-Nov-2032 24-Dec-2032 24-Jan-2033 24-Feb-2033 24-Mar-2033 24-Apr-2033 24-May-2033 24-Jun-2033 24-Jul-2033 24-Aug-2033 24-Sep-2033 24-Oct-2033 24-Nov-2033 24-Dec-2033 24-Jan-2034 24-Feb-2034 24-Mar-2034 24-Apr-2034 24-May-2034 24-Jun-2034 24-Jul-2034 24-Aug-2034 24-Sep-2034 24-Oct-2034 24-Nov-2034 24-Dec-2034 24-Jan-2035 24-Feb-2035 24-Mar-2035 24-Apr-2035 24-May-2035 24-Jun-2035 24-Jul-2035 24-Aug-2035 24-Sep-2035 24-Oct-2035 24-Nov-2035 24-Dec-2035 24-Jan-2036 24-Feb-2036 24-Mar-2036 24-Apr-2036 24-May-2036 24-Jun-2036 24-Jul-2036 24-Aug-2036 24-Sep-2036 24-Oct-2036 24-Nov-2036 24-Dec-2036 24-Jan-2037 24-Feb-2037 24-Mar-2037 24-Apr-2037 24-May-2037 24-Jun-2037 24-Jul-2037 24-Aug-2037 24-Sep-2037 24-Oct-2037 24-Nov-2037 24-Dec-2037 24-Jan-2038 24-Feb-2038 24-Mar-2038 24-Apr-2038 24-May-2038 24-Jun-2038 24-Jul-2038 24-Aug-2038 24-Sep-2038 24-Oct-2038 24-Nov-2038 24-Dec-2038 24-Jan-2039 24-Feb-2039 24-Mar-2039 24-Apr-2039 24-May-2039 24-Jun-2039 24-Jul-2039 24-Aug-2039 24-Sep-2039 24-Oct-2039 24-Nov-2039

rates = zerorates(SvenModel,maturities)

rates = 1×360

0.0083 0.0094 0.0105 0.0114 0.0124 0.0134 0.0143 0.0153 0.0162 0.0171 0.0179 0.0188 0.0196 0.0204 0.0212 0.0219 0.0226 0.0234 0.0241 0.0248 0.0255 0.0262 0.0268 0.0275 0.0281 0.0287 0.0293 0.0299 0.0304 0.0310 0.0316 0.0321 0.0326 0.0332 0.0336 0.0342 0.0346 0.0351 0.0356 0.0360 0.0365 0.0369 0.0373 0.0377 0.0382 0.0386 0.0389 0.0393 0.0397 0.0401

Plot the zero coupon rate.

plot(maturities,rates) xtickformat('yyyy') grid('on') xlabel('Time in Years') ylabel('Zero Coupon Rate')

More About

A fixed-rate note is a long-term debt security with a preset interest rate and maturity, by which the interest must be paid.

The principal might or might not be paid at maturity. In Financial Instruments Toolbox™, the principal is always paid at maturity. For more information, see Fixed-Rate Note.

A vanilla coupon bond is a security representing an obligation to repay a borrowed amount at a designated time and to make periodic interest payments until that time.

The issuer of a bond makes the periodic interest payments until the bond matures. At maturity, the issuer pays to the holder of the bond the principal amount owed (face value) and the last interest payment.

A step-up bond and a step-down bond are debt securities with a predetermined coupon structure over time.

With these instruments, coupons increase (step up) or decrease (step down) at specific times during the life of the bond.

An amortized bond is treated as an asset, with the discount amount being amortized to interest expense over the life of the bond.

Version History

Introduced in R2020aYou can price FixedBond instruments using a CoxIngersollRoss model object

and an IRTree pricing

method.

Although FixedBond supports serial date numbers,

datetime values are recommended instead. The

datetime data type provides flexible date and time

formats, storage out to nanosecond precision, and properties to account for time

zones and daylight saving time.

To convert serial date numbers or text to datetime values, use the datetime function. For example:

t = datetime(738427.656845093,"ConvertFrom","datenum"); y = year(t)

y =

2021

There are no plans to remove support for serial date number inputs.

See Also

Functions

MATLAB Command

You clicked a link that corresponds to this MATLAB command:

Run the command by entering it in the MATLAB Command Window. Web browsers do not support MATLAB commands.

Website auswählen

Wählen Sie eine Website aus, um übersetzte Inhalte (sofern verfügbar) sowie lokale Veranstaltungen und Angebote anzuzeigen. Auf der Grundlage Ihres Standorts empfehlen wir Ihnen die folgende Auswahl: .

Sie können auch eine Website aus der folgenden Liste auswählen:

So erhalten Sie die bestmögliche Leistung auf der Website

Wählen Sie für die bestmögliche Website-Leistung die Website für China (auf Chinesisch oder Englisch). Andere landesspezifische Websites von MathWorks sind für Besuche von Ihrem Standort aus nicht optimiert.

Amerika

- América Latina (Español)

- Canada (English)

- United States (English)

Europa

- Belgium (English)

- Denmark (English)

- Deutschland (Deutsch)

- España (Español)

- Finland (English)

- France (Français)

- Ireland (English)

- Italia (Italiano)

- Luxembourg (English)

- Netherlands (English)

- Norway (English)

- Österreich (Deutsch)

- Portugal (English)

- Sweden (English)

- Switzerland

- United Kingdom (English)