calcGreeks: Calculate option Greeks (European Black/Scholes)

calcGreeks computes and reports the fair price value and numerous Greek values for vanilla European options, using the Black-Scholes-Merton model, optimized for performance.

No toolbox is required - only basic Matlab.

Any input parameter can be vectorized (examples below). Note that only one parameter can be vectorized (any parameter that you choose).

calcGreeks is used by the IQFeed-Matlab connector (IQML) - https://undocumentedmatlab.com/IQML

Syntax:

[fairValue, greeks] = calcGreeks(spot, strike, rate, yield, volatility, maturity, putCallInd, annualFactor)

Inputs:

- spot - (mandatory) Underlying asset's spot price

- strike - (mandatory) Derivative contract's strike price

- rate - (default: 0) Domestic risk-free interest rate (%)

- yield - (default: 0) Foreign interest rate (Forex) or dividend yield (stock)

- volatility - (default: 0.3) Historic volatility of the underlying asset's price

- maturity - (default: 1.0) Number of years until the option contract expires

- putCallInd - (default: 'Call') Either 1 (Call), -1 (Put), or [1,-1] (both), or as strings. For example: "Call", 'put', 'cp', {'Call',"put"} etc.

- annualFactor - (default: 1) Used to de-annualize Theta, Charm, Veta, Color. Typical values: 1 (report annualized values), 365 (report 1-calendar-day estimates), or 252 (report 1-trading-day estimates)

Usage examples:

% Example 1: vectorized call/put

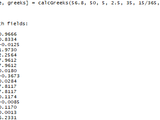

>> [fairValue, greeks] = calcGreeks(56.8, 60, 5, 2.5, 35, 15/365, {'call',"put"}, 365)

fairValue =

0.5348 3.6700

greeks =

struct with fields:

delta: [0.2347 -0.7642]

vega: 3.5347

theta: [-0.0421 -0.0378]

rho: [0.5260 -1.9347]

crho: [0.5480 -1.7839]

omega: [24.9311 -11.8278]

lambda: [24.9311 -11.8278]

gamma: 0.0762

vanna: 0.6959

charm: [-0.0025 -0.0275]

vomma: 5.7897

volga: 5.7897

veta: 0.1876

speed: 0.0123

zomma: -0.0929

color: -0.0010

ultima: -40.2881

% Example 2: vectorized strike prices

>> [fairValue, greeks] = calcGreeks(56.8, 45:5:65, 5, 2.5, 35, 15/365, 'c', 365)

fairValue =

11.8345 6.8966 2.6769 0.5348 0.0493

greeks =

struct with fields:

delta: [0.9985 0.9666 0.6921 0.2347 0.0321]

vega: [0.0178 0.8334 4.0419 3.5347 0.8280]

theta: [-0.0025 -0.0125 -0.0495 -0.0421 -0.0098]

rho: [1.8445 1.9730 1.5055 0.5260 0.0729]

crho: [2.3308 2.2564 1.6155 0.5480 0.0749]

omega: [4.7925 7.9612 14.6854 24.9311 36.9547]

lambda: [4.7925 7.9612 14.6854 24.9311 36.9547]

gamma: [3.8391e-04 0.0180 0.0871 0.0762 0.0178]

vanna: [-0.0144 -0.3673 -0.4341 0.6959 0.3948]

charm: [0.0251 0.0284 0.0220 -0.0025 -0.0039]

vomma: [0.5531 7.8117 2.5186 5.7897 8.4126]

volga: [0.5531 7.8117 2.5186 5.7897 8.4126]

veta: [0.0070 0.1174 0.1619 0.1876 0.1272]

speed: [-3.2418e-04 -0.0085 -0.0124 0.0123 0.0079]

zomma: [0.0108 0.1170 -0.1946 -0.0929 0.1303]

color: [1.2500e-04 0.0013 -0.0023 -0.0010 0.0016]

ultima: [12.4303 6.2331 -20.1849 -40.2881 13.3330]

Bugs and suggestions:

Please send to Yair Altman (altmany at gmail dot com)

Technical description:

https://en.wikipedia.org/wiki/Greeks_(finance)#Delta

Zitieren als

Yair Altman (2025). calcGreeks: Calculate option Greeks (European Black/Scholes) (https://www.mathworks.com/matlabcentral/fileexchange/69544-calcgreeks-calculate-option-greeks-european-black-scholes), MATLAB Central File Exchange. Abgerufen.

Kompatibilität der MATLAB-Version

Plattform-Kompatibilität

Windows macOS LinuxKategorien

Tags

Quellenangaben

Inspiriert von: PlotMeTheGreeks, Vanilla Option - Price - Black Scholes - Close Form, Vanilla Option - Greeks - Black Scholes - Close Form, IQML - Matlab connector to IQFeed

Community Treasure Hunt

Find the treasures in MATLAB Central and discover how the community can help you!

Start Hunting!Live Editor erkunden

Erstellen Sie Skripte mit Code, Ausgabe und formatiertem Text in einem einzigen ausführbaren Dokument.

| Version | Veröffentlicht | Versionshinweise | |

|---|---|---|---|

| 1.1.2 | Updated description; added IQML File-Exchange reference |

|

|

| 1.1.1 | another attempt to publish as a toolbox... |

|

|

| 1.1.0 | retrying to upload as a toolbox... |

|

|

| 1.0.0 |

|