KMV Credit Risk Model - Probability of Default - Default Risk

KMV-Merton model Probability of Default represented by Jin-Chuan Duan, Genevi`eve Gauthier and Jean-Guy Simonato (2005).

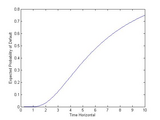

This code calculates the probability of default based on Moody’s KMV where firms equity follows a geometric Brownian motion presented by Merton and the probability of default is calculated bas on European call option of the firms market value. Newton-Raphson method is used to calculate the equity value provided the volatility of the equity.

Zitieren als

Haidar Haidar (2024). KMV Credit Risk Model - Probability of Default - Default Risk (https://www.mathworks.com/matlabcentral/fileexchange/34529-kmv-credit-risk-model-probability-of-default-default-risk), MATLAB Central File Exchange. Abgerufen.

Kompatibilität der MATLAB-Version

Plattform-Kompatibilität

Windows macOS LinuxKategorien

- Computational Finance > Risk Management Toolbox >

- Computational Finance > Financial Instruments Toolbox > Price Instruments Using Functions > Mortgage-Backed Securities >

- Mathematics and Optimization > Optimization Toolbox > Systems of Nonlinear Equations > Newton-Raphson Method >

Tags

Community Treasure Hunt

Find the treasures in MATLAB Central and discover how the community can help you!

Start Hunting!Live Editor erkunden

Erstellen Sie Skripte mit Code, Ausgabe und formatiertem Text in einem einzigen ausführbaren Dokument.

| Version | Veröffentlicht | Versionshinweise | |

|---|---|---|---|

| 1.1.0.0 | No updates, just added few comments to explain lines in the code. |

||

| 1.0.0.0 |