stepcpnyield

Yield to maturity of bond with stepped coupons

Syntax

Description

Examples

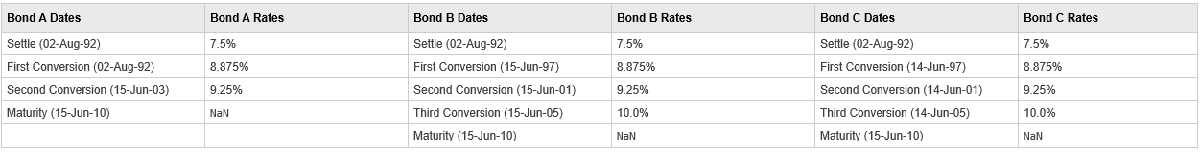

Find the yield to maturity of three stepped-coupon bonds of known price, given three conversion scenarios:

Bond A has two conversions, the first one falling on the settle date and immediately expiring.

Bond B has three conversions, with conversion dates exactly on the coupon dates.

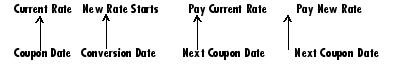

Bond C has three conversions, with one or more conversion dates not on coupon dates. This case illustrates that only cash flows for full periods after conversion dates are affected, as illustrated below.

The following table illustrates the interest-rate characteristics of this bond portfolio.

Define the specifications for the bonds.

format long Price = [117.3824; 113.4339; 113.4339]; Settle = datenum('02-Aug-1992'); ConvDates = [datenum('02-Aug-1992'), datenum('15-Jun-2003'), nan; datenum('15-Jun-1997'), datenum('15-Jun-2001'), datenum('15-Jun-2005'); datenum('14-Jun-1997'), datenum('14-Jun-2001'), datenum('14-Jun-2005')]; Maturity = datenum('15-Jun-2010'); CouponRates = [0.075 0.08875 0.0925 nan; 0.075 0.08875 0.0925 0.1; 0.075 0.08875 0.0925 0.1]; Basis = 1; Period = 2; EndMonthRule = 1; Face = 100;

Use stepcpnyield to compute the yield to maturity for the bonds with stepped coupons.

Yield = stepcpnyield(Price, Settle, Maturity, ConvDates, CouponRates, Period, Basis, EndMonthRule, Face)

Yield = 3×1

0.072214402049150

0.072214267800360

0.072864799557221

Input Arguments

Price of bond, specified as a scalar or

NUMBONDS-by-1 vector of numeric values.

Data Types: double

Settlement date, specified either as a scalar or

NUMBONDS-by-1 vector using serial date numbers

or date character vectors.

Settle must be earlier than Maturity.

Data Types: double | char

Maturity date, specified as a scalar or an

NUMBONDS-by-1 vector using serial date numbers

or date character vectors that represent the maturity date for each bond.

Data Types: double | char

Conversion dates, specified as a

NSTP-by-max(NCONV) matrix using serial date

numbers or date character vectors that contain conversion dates after

Settle. The size of the matrix is equal to the number of

instruments by the maximum number of conversions. Fill unspecified entries with

NaN.

Data Types: double | char

Bond coupon rate, specified as an

NSTP-by-max(NCONV+1) matrix containing coupon

rates for each bond in the portfolio in decimal form. The matrix size is equal to the

number of instruments by maximum number of conversions + 1. First column of this matrix

contains rates applicable between Settle and the first conversion

date (date in the first column of ConvDates). Fill unspecified

entries with NaN

ConvDates has the same number of rows as

CouponRates to reflect the same number of bonds. However,

ConvDates has one less column than

CouponRates. This situation is illustrated by

Settle---------ConvDate1-----------ConvDate2------------Maturity

Rate1 Rate2 Rate3Data Types: double

(Optional) Coupons per year, specified as an

NUMBONDS-by-1 vector. Values for

Period are 1, 2,

3, 4, 6, and

12.

Data Types: double

(Optional) Day-count basis of each instrument, specified as an

NUMBONDS-by-1 vector.

0 = actual/actual

1 = 30/360 (SIA)

2 = actual/360

3 = actual/365

4 = 30/360 (PSA)

5 = 30/360 (ISDA)

6 = 30/360 (European)

7 = actual/365 (Japanese)

8 = actual/actual (ICMA)

9 = actual/360 (ICMA)

10 = actual/365 (ICMA)

11 = 30/360E (ICMA)

12 = actual/365 (ISDA)

13 = BUS/252

For more information, see Basis.

Data Types: double

(Optional) End-of-month rule flag for generating dates when

Maturity is an end-of-month date for a month having 30 or fewer

days, specified for each bond as a nonnegative integer [0,

1] using a NUMBONDS-by-1 vector.

0= Ignore rule, meaning that a payment date is always the same numerical day of the month.1= Set rule on, meaning that a payment date is always the last actual day of the month.

Data Types: logical

(Optional) Face value, specified for each bond as an

NUMBONDS-by-1 vector of nonnegative face

values.

Data Types: double

Output Arguments

Yield to maturity, returned as a NUMBONDS-by-1

vector in decimal form.

Note

For bonds with fixed coupons, use bndyield. You receive the error incorrect number of

inputs if you use a fixed-coupon bond with

stepcpnyield.

More About

A stepped coupon is a type of bond or fixed-income security that features a coupon rate that increases (or "steps up") at predetermined intervals over the life of the bond.

The stepped coupon structure is designed to provide investors with higher interest payments as time progresses, making it attractive in environments where interest rates are expected to rise.

Version History

Introduced before R2006a

MATLAB Command

You clicked a link that corresponds to this MATLAB command:

Run the command by entering it in the MATLAB Command Window. Web browsers do not support MATLAB commands.

Website auswählen

Wählen Sie eine Website aus, um übersetzte Inhalte (sofern verfügbar) sowie lokale Veranstaltungen und Angebote anzuzeigen. Auf der Grundlage Ihres Standorts empfehlen wir Ihnen die folgende Auswahl: .

Sie können auch eine Website aus der folgenden Liste auswählen:

So erhalten Sie die bestmögliche Leistung auf der Website

Wählen Sie für die bestmögliche Website-Leistung die Website für China (auf Chinesisch oder Englisch). Andere landesspezifische Websites von MathWorks sind für Besuche von Ihrem Standort aus nicht optimiert.

Amerika

- América Latina (Español)

- Canada (English)

- United States (English)

Europa

- Belgium (English)

- Denmark (English)

- Deutschland (Deutsch)

- España (Español)

- Finland (English)

- France (Français)

- Ireland (English)

- Italia (Italiano)

- Luxembourg (English)

- Netherlands (English)

- Norway (English)

- Österreich (Deutsch)

- Portugal (English)

- Sweden (English)

- Switzerland

- United Kingdom (English)