Vanilla

Vanilla instrument object

Description

Create and price a Vanilla instrument object for one or

more Vanilla instruments using this workflow:

Use

fininstrumentto create aVanillainstrument object for one or more Vanilla instruments.Use

finmodelto specify aBlackScholes,Bachelier,Heston,Bates,Merton,RoughBergomi,RoughHeston, orDupiremodel for theVanillainstrument object.Choose a pricing method.

When using a

BlackScholesmodel, usefinpricerto specify aFiniteDifference,BlackScholes,BjerksundStensland,RollGeskeWhaley,VannaVolga,AssetTree, orAssetMonteCarlopricing method for one or moreVanillainstruments.When using a

Heston,Bates, orMertonmodel, usefinpricerto specify aFiniteDifference,NumericalIntegration,FFT, orAssetMonteCarlopricing method for one or moreVanillainstruments.When using a

Dupiremodel, usefinpricerto specify aFiniteDifferencepricing method for one or moreVanillainstruments.When using a

Bacheliermodel, usefinpricerto specify anAssetMonteCarlopricing method for one or moreVanillainstruments.When using a

RoughBergomiorRoughHestonmodel, usefinpricerto specify aRoughVolMonteCarlopricing method for one or moreVanillainstruments.

For more information on this workflow, see Get Started with Workflows Using Object-Based Framework for Pricing Financial Instruments.

For more information on the available models and pricing methods for a

Vanilla instrument, see Choose Instruments, Models, and Pricers.

Creation

Syntax

Description

VanillaObj = fininstrument(InstrumentType,'Strike',strike_value,'ExerciseDate',exercise_date)Vanilla object for one or more Vanilla

instruments by specifying InstrumentType and sets the

properties for the

required name-value pair arguments Strike and

ExerciseDate. For more information on a

Vanilla instrument, see More About.

VanillaObj = fininstrument(___,Name,Value)VanillaObj =

fininstrument("Vanilla",'Strike',100,'ExerciseDate',datetime(2019,1,30),'OptionType',"put",'ExerciseStyle',"American",'Name',"vanilla_instrument")

creates a Vanilla put option with an American exercise.

You can specify multiple name-value pair arguments.

Input Arguments

Instrument type, specified as a string with the value of

"Vanilla", a character vector with the value of

'Vanilla', an

NINST-by-1 string array with

values of "Vanilla", or an

NINST-by-1 cell array of

character vectors with values of 'Vanilla'.

Data Types: char | cell | string

Name-Value Arguments

Specify required

and optional pairs of arguments as

Name1=Value1,...,NameN=ValueN, where

Name is the argument name and Value is

the corresponding value. Name-value arguments must appear after other arguments,

but the order of the pairs does not matter.

Before R2021a, use commas to separate each name and value, and enclose

Name in quotes.

Example: VanillaObj =

fininstrument("Vanilla",'Strike',100,'ExerciseDate',datetime(2019,1,30),'OptionType',"put",'ExerciseStyle',"American",'Name',"vanilla_instrument")

Required Vanilla Name-Value Pair Arguments

Option strike price value, specified as the comma-separated pair

consisting of 'Strike' and a scalar nonnegative

numeric value or an NINST-by-1

nonnegative numeric vector.

Note

When using a "Bermudan"

ExerciseStyle with a FiniteDifference pricer, the

Strike is a vector.

Data Types: double

Option exercise date, specified as the comma-separated pair

consisting of 'ExerciseDate' and a scalar or an

NINST-by-1 vector using a

datetime array, string array, or date character vectors.

Note

For a European option, there is only one

ExerciseDate on the option expiry

date.

When using a "Bermudan"

ExerciseStyle with a FiniteDifference pricer, the

ExerciseDate is a vector.

To support existing code, Vanilla also

accepts serial date numbers as inputs, but they are not recommended.

If you use date character vectors or strings, the format must be

recognizable by datetime because

the ExerciseDate property is stored as a

datetime.

Optional Vanilla Name-Value Pair Arguments

Option type, specified as the comma-separated pair consisting of

'OptionType' and a scalar string or character

vector or an NINST-by-1 cell

array of character vectors or string array.

A call option gives the holder the right to buy the underlying asset at the strike price, while a put option gives the holder the right to sell the underlying asset at the strike price.

Note

When you use a RollGeskeWhaley pricer with a

Vanilla option,

OptionType must be

'call'.

Data Types: char | cell | string

Option exercise style, specified as the comma-separated pair

consisting of 'ExerciseStyle' and a scalar string

or character vector or an

NINST-by-1 cell array of

character vectors or string array.

Note

When you use a

BlackScholespricer with aVanillaoption, the'American'option type is not supported.When you use a

RollGeskeWhaleyor aBjerksundStenslandpricer with aVanillaoption, you must specify an'American'option.When you use a

NumericalIntegrationpricer with aBates,Merton, orHestonmodel for aVanillaoption, theExerciseStylemust be'European'.When you use a

FFTpricer with aBates,Merton, orHestonmodel for aVanillaoption, theExerciseStylemust be'European'.When you use an

AssetMonteCarlopricer with aBlackScholes,Bates,Merton, orHestonmodel for aVanillaoption, theExerciseStylecan be'American','European', or'Bermudan'.When you use a

FiniteDifferencepricer with aBlackScholes,Bachelier,Dupire,Bates,Merton, orHestonmodel for aVanillaoption, theExerciseStylecan be'American','European', or'Bermudan'.

For more information on

ExerciseStyle, see Supported Exercise Styles.

Data Types: string | cell | char

User-defined name for one of more instruments, specified as the

comma-separated pair consisting of 'Name' and a

scalar string or character vector or an

NINST-by-1 cell array of

character vectors or string array.

Data Types: char | cell | string

Output Arguments

Vanilla instrument, returned as a Vanilla

object.

Properties

Option strike price value, returned as a scalar nonnegative numeric or an

NINST-by-1 nonnegative numeric

vector.

Data Types: double

Option exercise date, returned as a scalar datetime or an

NINST-by-1 vector of

datetimes.

Data Types: datetime

Option type, returned as a scalar string or an

NINST-by-1 string array with

values of "call" or "put".

Data Types: string

Option exercise style, returned as a scalar string or an

NINST-by-1 string array with

values of "European", "American", or

"Bermudan".

Data Types: string

User-defined name for the instrument, returned as a scalar string or an

NINST-by-1 string array.

Data Types: string

Object Functions

setExercisePolicy | Set exercise policy for FixedBondOption,

FloatBondOption, or Vanilla instrument |

Examples

This example shows the workflow to price a Vanilla instrument when you use a BlackScholes model and a BlackScholes pricing method.

Create Vanilla Instrument Object

Use fininstrument to create a Vanilla instrument object.

VanillaOpt = fininstrument("Vanilla",'ExerciseDate',datetime(2018,5,1),'Strike',29,'OptionType',"put",'ExerciseStyle',"european",'Name',"vanilla_option")

VanillaOpt =

Vanilla with properties:

OptionType: "put"

ExerciseStyle: "european"

ExerciseDate: 01-May-2018

Strike: 29

Name: "vanilla_option"

Create BlackScholes Model Object

Use finmodel to create a BlackScholes model object.

BlackScholesModel = finmodel("BlackScholes",'Volatility',0.25)

BlackScholesModel =

BlackScholes with properties:

Volatility: 0.2500

Correlation: 1

Create ratecurve Object

Create a flat ratecurve object using ratecurve.

Settle = datetime(2018,1,1); Maturity = datetime(2019,1,1); Rate = 0.05; myRC = ratecurve('zero',Settle,Maturity,Rate,'Basis',1)

myRC =

ratecurve with properties:

Type: "zero"

Compounding: -1

Basis: 1

Dates: 01-Jan-2019

Rates: 0.0500

Settle: 01-Jan-2018

InterpMethod: "linear"

ShortExtrapMethod: "next"

LongExtrapMethod: "previous"

Create BlackScholes Pricer Object

Use finpricer to create a BlackScholes pricer object and use the ratecurve object for the 'DiscountCurve' name-value pair argument.

outPricer = finpricer("analytic",'DiscountCurve',myRC,'Model',BlackScholesModel,'SpotPrice',30,'DividendValue',0.045)

outPricer =

BlackScholes with properties:

DiscountCurve: [1×1 ratecurve]

Model: [1×1 finmodel.BlackScholes]

SpotPrice: 30

DividendValue: 0.0450

DividendType: "continuous"

Price Vanilla Instrument

Use price to compute the price and sensitivities for the Vanilla instrument.

[Price, outPR] = price(outPricer,VanillaOpt,["all"])Price = 1.2046

outPR =

priceresult with properties:

Results: [1×7 table]

PricerData: []

outPR.Results

ans=1×7 table

Price Delta Gamma Lambda Vega Rho Theta

______ ________ ________ _______ ______ _______ _______

1.2046 -0.36943 0.086269 -9.3396 6.4702 -4.0959 -2.3107

This example shows the workflow to price multiple Vanilla instrument when you use a BlackScholes model and a BlackScholes pricing method.

Create Vanilla Instrument Object

Use fininstrument to create a Vanilla instrument object for three Vanilla instruments.

VanillaOpt = fininstrument("Vanilla",'ExerciseDate',datetime([2018,5,1 ; 2018,6,1 ; 2018,7,1]),'Strike',[29 ; 38 ; 70],'OptionType',"put",'ExerciseStyle',"european",'Name',"vanilla_option")

VanillaOpt=3×1 Vanilla array with properties:

OptionType

ExerciseStyle

ExerciseDate

Strike

Name

Create BlackScholes Model Object

Use finmodel to create a BlackScholes model object.

BlackScholesModel = finmodel("BlackScholes",'Volatility',0.25)

BlackScholesModel =

BlackScholes with properties:

Volatility: 0.2500

Correlation: 1

Create ratecurve Object

Create a flat ratecurve object using ratecurve.

Settle = datetime(2018,1,1); Maturity = datetime(2019,1,1); Rate = 0.05; myRC = ratecurve('zero',Settle,Maturity,Rate,'Basis',1)

myRC =

ratecurve with properties:

Type: "zero"

Compounding: -1

Basis: 1

Dates: 01-Jan-2019

Rates: 0.0500

Settle: 01-Jan-2018

InterpMethod: "linear"

ShortExtrapMethod: "next"

LongExtrapMethod: "previous"

Create BlackScholes Pricer Object

Use finpricer to create a BlackScholes pricer object and use the ratecurve object for the 'DiscountCurve' name-value pair argument.

outPricer = finpricer("analytic",'DiscountCurve',myRC,'Model',BlackScholesModel,'SpotPrice',30,'DividendValue',0.045)

outPricer =

BlackScholes with properties:

DiscountCurve: [1×1 ratecurve]

Model: [1×1 finmodel.BlackScholes]

SpotPrice: 30

DividendValue: 0.0450

DividendType: "continuous"

Price Vanilla Instruments

Use price to compute the prices and sensitivities for the Vanilla instruments.

[Price, outPR] = price(outPricer,VanillaOpt,["all"])Price = 3×1

1.2046

7.9479

38.9392

outPR=3×1 priceresult array with properties:

Results

PricerData

outPR.Results

ans=1×7 table

Price Delta Gamma Lambda Vega Rho Theta

______ ________ ________ _______ ______ _______ _______

1.2046 -0.36943 0.086269 -9.3396 6.4702 -4.0959 -2.3107

ans=1×7 table

Price Delta Gamma Lambda Vega Rho Theta

______ ________ ________ _______ ______ _______ _______

7.9479 -0.89786 0.031587 -3.4532 2.9612 -14.535 -0.3563

ans=1×7 table

Price Delta Gamma Lambda Vega Rho Theta

______ ________ __________ ________ __________ _______ ______

38.939 -0.97775 1.2279e-06 -0.77043 0.00013814 -34.136 2.0936

This example shows the workflow to price a Vanilla instrument when you use a BlackScholes model and an AssetTree pricing method using a Leisen-Reimer (LR) binomial tree.

Create Vanilla Instrument Object

Use fininstrument to create a Vanilla instrument object.

VanillaOpt = fininstrument("Vanilla",'ExerciseDate',datetime(2018,5,1),'Strike',29,'OptionType',"put",'ExerciseStyle',"european",'Name',"vanilla_option")

VanillaOpt =

Vanilla with properties:

OptionType: "put"

ExerciseStyle: "european"

ExerciseDate: 01-May-2018

Strike: 29

Name: "vanilla_option"

Create BlackScholes Model Object

Use finmodel to create a BlackScholes model object.

BlackScholesModel = finmodel("BlackScholes",'Volatility',0.25)

BlackScholesModel =

BlackScholes with properties:

Volatility: 0.2500

Correlation: 1

Create ratecurve Object

Create a flat ratecurve object using ratecurve.

Settle = datetime(2018,1,1); Maturity = datetime(2019,1,1); Rate = 0.05; myRC = ratecurve('zero',Settle,Maturity,Rate,'Basis',1)

myRC =

ratecurve with properties:

Type: "zero"

Compounding: -1

Basis: 1

Dates: 01-Jan-2019

Rates: 0.0500

Settle: 01-Jan-2018

InterpMethod: "linear"

ShortExtrapMethod: "next"

LongExtrapMethod: "previous"

Create AssetTree Pricer Object

Use finpricer to create an AssetTree pricer object for a LR equity tree and use the ratecurve object for the 'DiscountCurve' name-value pair argument.

NumPeriods = 15; LRPricer = finpricer("AssetTree",'DiscountCurve',myRC,'Model',BlackScholesModel,'SpotPrice',50,'PricingMethod',"LeisenReimer",'Maturity',datetime(2018,5,1),'NumPeriods',NumPeriods)

LRPricer =

LRTree with properties:

InversionMethod: PP1

Strike: 50

Tree: [1×1 struct]

NumPeriods: 15

Model: [1×1 finmodel.BlackScholes]

DiscountCurve: [1×1 ratecurve]

SpotPrice: 50

DividendType: "continuous"

DividendValue: 0

TreeDates: [09-Jan-2018 17-Jan-2018 25-Jan-2018 02-Feb-2018 10-Feb-2018 18-Feb-2018 26-Feb-2018 06-Mar-2018 14-Mar-2018 22-Mar-2018 30-Mar-2018 07-Apr-2018 15-Apr-2018 23-Apr-2018 01-May-2018]

LRPricer.Tree

ans = struct with fields:

Probs: [2×15 double]

ATree: {1×16 cell}

dObs: [01-Jan-2018 09-Jan-2018 17-Jan-2018 25-Jan-2018 02-Feb-2018 10-Feb-2018 18-Feb-2018 26-Feb-2018 06-Mar-2018 14-Mar-2018 22-Mar-2018 30-Mar-2018 07-Apr-2018 15-Apr-2018 23-Apr-2018 01-May-2018]

tObs: [0 0.0222 0.0444 0.0667 0.0889 0.1111 0.1333 0.1556 0.1778 0.2000 0.2222 0.2444 0.2667 0.2889 0.3111 0.3333]

Price Vanilla Instrument

Use price to compute the price and sensitivities for the Vanilla instrument.

[Price, outPR] = price(LRPricer,VanillaOpt,["all"])Price = 3.5022e-06

outPR =

priceresult with properties:

Results: [1×7 table]

PricerData: [1×1 struct]

outPR.Results

ans=1×7 table

Price Delta Gamma Vega Lambda Rho Theta

__________ ___________ __________ _________ _______ ___________ ___________

3.5022e-06 -1.9331e-06 1.1068e-06 0.0016243 -30.496 -3.6747e-05 -0.00060106

outPR.PricerData.PriceTree

ans = struct with fields:

PTree: {1×16 cell}

ExTree: {1×16 cell}

tObs: [0 0.0222 0.0444 0.0667 0.0889 0.1111 0.1333 0.1556 0.1778 0.2000 0.2222 0.2444 0.2667 0.2889 0.3111 0.3333]

dObs: [01-Jan-2018 09-Jan-2018 17-Jan-2018 25-Jan-2018 02-Feb-2018 10-Feb-2018 18-Feb-2018 26-Feb-2018 06-Mar-2018 14-Mar-2018 22-Mar-2018 30-Mar-2018 07-Apr-2018 15-Apr-2018 23-Apr-2018 01-May-2018]

Probs: [2×15 double]

outPR.PricerData.PriceTree.ExTree

ans=1×16 cell array

{[0]} {[0 0]} {[0 0 0]} {[0 0 0 0]} {[0 0 0 0 0]} {[0 0 0 0 0 0]} {[0 0 0 0 0 0 0]} {[0 0 0 0 0 0 0 0]} {[0 0 0 0 0 0 0 0 0]} {[0 0 0 0 0 0 0 0 0 0]} {[0 0 0 0 0 0 0 0 0 0 0]} {[0 0 0 0 0 0 0 0 0 0 0 0]} {[0 0 0 0 0 0 0 0 0 0 0 0 0]} {[0 0 0 0 0 0 0 0 0 0 0 0 0 0]} {[0 0 0 0 0 0 0 0 0 0 0 0 0 0 0]} {[0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 1]}

This example shows the workflow to price a Vanilla instrument when you use a BlackScholes model and an AssetTree pricing method using a Standard Trinomial (STT) tree.

Create Vanilla Instrument Object

Use fininstrument to create a Vanilla instrument object.

VanillaOpt = fininstrument("Vanilla",'ExerciseDate',datetime(2018,5,1),'Strike',29,'OptionType',"put",'ExerciseStyle',"european",'Name',"vanilla_option")

VanillaOpt =

Vanilla with properties:

OptionType: "put"

ExerciseStyle: "european"

ExerciseDate: 01-May-2018

Strike: 29

Name: "vanilla_option"

Create BlackScholes Model Object

Use finmodel to create a BlackScholes model object.

BlackScholesModel = finmodel("BlackScholes",'Volatility',0.25)

BlackScholesModel =

BlackScholes with properties:

Volatility: 0.2500

Correlation: 1

Create ratecurve Object

Create a flat ratecurve object using ratecurve.

Settle = datetime(2018,1,1); Maturity = datetime(2019,1,1); Rate = 0.05; myRC = ratecurve('zero',Settle,Maturity,Rate,'Basis',1)

myRC =

ratecurve with properties:

Type: "zero"

Compounding: -1

Basis: 1

Dates: 01-Jan-2019

Rates: 0.0500

Settle: 01-Jan-2018

InterpMethod: "linear"

ShortExtrapMethod: "next"

LongExtrapMethod: "previous"

Create AssetTree Pricer Object

Use finpricer to create an AssetTree pricer object for a Standard Trinomial (STT) equity tree and use the ratecurve object for the 'DiscountCurve' name-value pair argument.

NumPeriods = 15; STTPricer = finpricer("AssetTree",'DiscountCurve',myRC,'Model',BlackScholesModel,'SpotPrice',50,'PricingMethod',"StandardTrinomial",'Maturity',datetime(2018,5,1),'NumPeriods',NumPeriods)

STTPricer =

STTree with properties:

Tree: [1×1 struct]

NumPeriods: 15

Model: [1×1 finmodel.BlackScholes]

DiscountCurve: [1×1 ratecurve]

SpotPrice: 50

DividendType: "continuous"

DividendValue: 0

TreeDates: [09-Jan-2018 17-Jan-2018 25-Jan-2018 02-Feb-2018 10-Feb-2018 18-Feb-2018 26-Feb-2018 06-Mar-2018 14-Mar-2018 22-Mar-2018 30-Mar-2018 07-Apr-2018 15-Apr-2018 23-Apr-2018 01-May-2018]

STTPricer.Tree

ans = struct with fields:

ATree: {1×16 cell}

Probs: {[3×1 double] [3×3 double] [3×5 double] [3×7 double] [3×9 double] [3×11 double] [3×13 double] [3×15 double] [3×17 double] [3×19 double] [3×21 double] [3×23 double] [3×25 double] [3×27 double] [3×29 double]}

dObs: [01-Jan-2018 09-Jan-2018 17-Jan-2018 25-Jan-2018 02-Feb-2018 10-Feb-2018 18-Feb-2018 26-Feb-2018 06-Mar-2018 14-Mar-2018 22-Mar-2018 30-Mar-2018 07-Apr-2018 15-Apr-2018 23-Apr-2018 01-May-2018]

tObs: [0 0.0222 0.0444 0.0667 0.0889 0.1111 0.1333 0.1556 0.1778 0.2000 0.2222 0.2444 0.2667 0.2889 0.3111 0.3333]

Price Vanilla Instrument

Use price to compute the price and sensitivities for the Vanilla instrument.

[Price, outPR] = price(STTPricer,VanillaOpt,["all"])Price = 6.3773e-05

outPR =

priceresult with properties:

Results: [1×7 table]

PricerData: [1×1 struct]

outPR.Results

ans=1×7 table

Price Delta Gamma Vega Lambda Rho Theta

__________ ___________ __________ _________ _______ ___________ _________

6.3773e-05 -9.1432e-06 1.2388e-06 0.0034421 -21.514 -0.00064994 -0.001188

outPR.PricerData.PriceTree

ans = struct with fields:

PTree: {1×16 cell}

ExTree: {1×16 cell}

tObs: [0 0.0222 0.0444 0.0667 0.0889 0.1111 0.1333 0.1556 0.1778 0.2000 0.2222 0.2444 0.2667 0.2889 0.3111 0.3333]

dObs: [01-Jan-2018 09-Jan-2018 17-Jan-2018 25-Jan-2018 02-Feb-2018 10-Feb-2018 18-Feb-2018 26-Feb-2018 06-Mar-2018 14-Mar-2018 22-Mar-2018 30-Mar-2018 07-Apr-2018 15-Apr-2018 23-Apr-2018 01-May-2018]

Probs: {[3×1 double] [3×3 double] [3×5 double] [3×7 double] [3×9 double] [3×11 double] [3×13 double] [3×15 double] [3×17 double] [3×19 double] [3×21 double] [3×23 double] [3×25 double] [3×27 double] [3×29 double]}

outPR.PricerData.PriceTree.ExTree

ans=1×16 cell array

{[0]} {[0 0 0]} {[0 0 0 0 0]} {[0 0 0 0 0 0 0]} {[0 0 0 0 0 0 0 0 0]} {[0 0 0 0 0 0 0 0 0 0 0]} {[0 0 0 0 0 0 0 0 0 0 0 0 0]} {[0 0 0 0 0 0 0 0 0 0 0 0 0 0 0]} {[0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0]} {[0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0]} {[0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0]} {[0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0]} {[0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0]} {[0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0]} {[0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0]} {[0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 1 1 1 1 1 1 1]}

This example shows the workflow to price an American option for a Vanilla instrument when you use a BlackScholes model and a RollGeskeWhaley pricing method.

Create Vanilla Instrument Object

Use fininstrument to create a Vanilla instrument object.

VanillaOpt = fininstrument("Vanilla",'Strike',105,'ExerciseDate',datetime(2022,9,15),'OptionType',"call",'ExerciseStyle',"american",'Name',"vanilla_option")

VanillaOpt =

Vanilla with properties:

OptionType: "call"

ExerciseStyle: "american"

ExerciseDate: 15-Sep-2022

Strike: 105

Name: "vanilla_option"

Create BlackScholes Model Object

Use finmodel to create a BlackScholes model object.

BlackScholesModel = finmodel("BlackScholes","Volatility",0.2)

BlackScholesModel =

BlackScholes with properties:

Volatility: 0.2000

Correlation: 1

Create ratecurve Object

Create a flat ratecurve object using ratecurve.

Settle = datetime(2018,9,15); Maturity = datetime(2023,9,15); Rate = 0.035; myRC = ratecurve('zero',Settle,Maturity,Rate,'Basis',12)

myRC =

ratecurve with properties:

Type: "zero"

Compounding: -1

Basis: 12

Dates: 15-Sep-2023

Rates: 0.0350

Settle: 15-Sep-2018

InterpMethod: "linear"

ShortExtrapMethod: "next"

LongExtrapMethod: "previous"

Create RollGeskeWhaley Pricer Object

Use finpricer to create a RollGeskeWhaley pricer object and use the ratecurve object for the 'DiscountCurve' name-value pair argument.

outPricer = finpricer("analytic",'Model',BlackScholesModel,'DiscountCurve',myRC,'SpotPrice',100,'DividendValue',timetable(datetime(2021,6,15),0.25),'PricingMethod',"RollGeskeWhaley")

outPricer =

RollGeskeWhaley with properties:

DiscountCurve: [1×1 ratecurve]

Model: [1×1 finmodel.BlackScholes]

SpotPrice: 100

DividendValue: [1×1 timetable]

DividendType: "cash"

Price Vanilla Instrument

Use price to compute the price and sensitivities for the Vanilla instrument.

[Price, outPR] = price(outPricer,VanillaOpt,["all"])Price = 19.9066

outPR =

priceresult with properties:

Results: [1×7 table]

PricerData: []

outPR.Results

ans=1×7 table

Price Delta Gamma Lambda Vega Theta Rho

______ _______ _________ ______ ______ _______ ______

19.907 0.66568 0.0090971 3.344 72.804 -3.4537 186.68

This example shows the workflow to price a Vanilla instrument for foreign exchange (FX) when you use a BlackScholes model and a BlackScholes pricing method. Assume that the current exchange rate is $0.52 and has a volatility of 12% per annum. The annualized continuously compounded foreign risk-free rate is 8% per annum.

Create Vanilla Instrument Object

Use fininstrument to create a Vanilla instrument object.

VanillaOpt = fininstrument("Vanilla",'ExerciseDate',datetime(2022,9,15),'Strike',.50,'OptionType',"put",'ExerciseStyle',"european",'Name',"vanilla_fx_option")

VanillaOpt =

Vanilla with properties:

OptionType: "put"

ExerciseStyle: "european"

ExerciseDate: 15-Sep-2022

Strike: 0.5000

Name: "vanilla_fx_option"

Create BlackScholes Model Object

Use finmodel to create a BlackScholes model object.

Sigma = .12; BlackScholesModel = finmodel("BlackScholes","Volatility",Sigma)

BlackScholesModel =

BlackScholes with properties:

Volatility: 0.1200

Correlation: 1

Create ratecurve Object

Create a flat ratecurve object using ratecurve.

Settle = datetime(2018,9,15); Maturity = datetime(2023,9,15); Rate = 0.035; myRC = ratecurve('zero',Settle,Maturity,Rate,'Basis',12)

myRC =

ratecurve with properties:

Type: "zero"

Compounding: -1

Basis: 12

Dates: 15-Sep-2023

Rates: 0.0350

Settle: 15-Sep-2018

InterpMethod: "linear"

ShortExtrapMethod: "next"

LongExtrapMethod: "previous"

Create BlackScholes Pricer Object

Use finpricer to create a BlackScholes pricer object and use the ratecurve object for the 'DiscountCurve' name-value pair argument. When pricing currencies using a Vanilla instrument, the DividendType must be 'continuous' and DividendValue is the annualized risk-free interest rate in the foreign country.

ForeignRate = 0.08; outPricer = finpricer("analytic",'DiscountCurve',myRC,'Model',BlackScholesModel,'SpotPrice',.52,'DividendType',"continuous",'DividendValue',ForeignRate)

outPricer =

BlackScholes with properties:

DiscountCurve: [1×1 ratecurve]

Model: [1×1 finmodel.BlackScholes]

SpotPrice: 0.5200

DividendValue: 0.0800

DividendType: "continuous"

Price Vanilla FX Instrument

Use price to compute the price and sensitivities for the Vanilla FX instrument.

[Price, outPR] = price(outPricer,VanillaOpt,["all"])Price = 0.0738

outPR =

priceresult with properties:

Results: [1×7 table]

PricerData: []

outPR.Results

ans=1×7 table

Price Delta Gamma Lambda Vega Rho Theta

________ ________ ______ _______ _______ _______ _________

0.073778 -0.49349 2.0818 -4.7899 0.27021 -1.3216 -0.013019

This example shows the workflow to price an American option for a Vanilla instrument when you use a BlackScholes model and an AssetMonteCarlo pricing method.

Create Vanilla Instrument Object

Use fininstrument to create a Vanilla instrument object.

VanillaOpt = fininstrument("Vanilla",'Strike',105,'ExerciseDate',datetime(2022,9,15),'OptionType',"call",'ExerciseStyle',"american",'Name',"vanilla_option")

VanillaOpt =

Vanilla with properties:

OptionType: "call"

ExerciseStyle: "american"

ExerciseDate: 15-Sep-2022

Strike: 105

Name: "vanilla_option"

Create BlackScholes Model Object

Use finmodel to create a BlackScholes model object.

BlackScholesModel = finmodel("BlackScholes","Volatility",0.2)

BlackScholesModel =

BlackScholes with properties:

Volatility: 0.2000

Correlation: 1

Create ratecurve Object

Create a flat ratecurve object using ratecurve.

Settle = datetime(2018,9,15); Maturity = datetime(2023,9,15); Rate = 0.035; myRC = ratecurve('zero',Settle,Maturity,Rate,'Basis',12)

myRC =

ratecurve with properties:

Type: "zero"

Compounding: -1

Basis: 12

Dates: 15-Sep-2023

Rates: 0.0350

Settle: 15-Sep-2018

InterpMethod: "linear"

ShortExtrapMethod: "next"

LongExtrapMethod: "previous"

Create AssetMonteCarlo Pricer Object

Use finpricer to create an AssetMonteCarlo pricer object and use the ratecurve object for the 'DiscountCurve' name-value pair argument.

outPricer = finpricer("AssetMonteCarlo",'DiscountCurve',myRC,"Model",BlackScholesModel,'SpotPrice',150,'simulationDates',datetime(2022,9,15))

outPricer =

GBMMonteCarlo with properties:

DiscountCurve: [1×1 ratecurve]

SpotPrice: 150

SimulationDates: 15-Sep-2022

NumTrials: 1000

RandomNumbers: []

Model: [1×1 finmodel.BlackScholes]

DividendType: "continuous"

DividendValue: 0

MonteCarloMethod: "standard"

BrownianMotionMethod: "standard"

Price Vanilla Instrument

Use price to compute the price and sensitivities for the Vanilla instrument.

[Price, outPR] = price(outPricer,VanillaOpt,["all"])Price = 61.2010

outPR =

priceresult with properties:

Results: [1×7 table]

PricerData: [1×1 struct]

outPR.Results

ans=1×7 table

Price Delta Gamma Lambda Rho Theta Vega

______ _______ _________ ______ ______ _______ ______

61.201 0.93074 0.0027813 2.2812 313.95 -3.7909 41.626

This example shows the workflow to price an American option for a Vanilla instrument when you use a BlackScholes model and an AssetMonteCarlo pricing method with quasi-Monte Carlo simulation.

Create Vanilla Instrument Object

Use fininstrument to create a Vanilla instrument object.

VanillaOpt = fininstrument("Vanilla",'Strike',105,'ExerciseDate',datetime(2022,9,15),'OptionType',"call",'ExerciseStyle',"american",'Name',"vanilla_option")

VanillaOpt =

Vanilla with properties:

OptionType: "call"

ExerciseStyle: "american"

ExerciseDate: 15-Sep-2022

Strike: 105

Name: "vanilla_option"

Create BlackScholes Model Object

Use finmodel to create a BlackScholes model object.

BlackScholesModel = finmodel("BlackScholes","Volatility",0.2)

BlackScholesModel =

BlackScholes with properties:

Volatility: 0.2000

Correlation: 1

Create ratecurve Object

Create a flat ratecurve object using ratecurve.

Settle = datetime(2018,9,15); Maturity = datetime(2023,9,15); Rate = 0.035; myRC = ratecurve('zero',Settle,Maturity,Rate,'Basis',12)

myRC =

ratecurve with properties:

Type: "zero"

Compounding: -1

Basis: 12

Dates: 15-Sep-2023

Rates: 0.0350

Settle: 15-Sep-2018

InterpMethod: "linear"

ShortExtrapMethod: "next"

LongExtrapMethod: "previous"

Create AssetMonteCarlo Pricer Object

Use finpricer to create an AssetMonteCarlo pricer object and use the ratecurve object for the 'DiscountCurve' name-value argument and the name-value arguments for MonteCarloMethod and BrownianMotionMethod.

outPricer = finpricer("AssetMonteCarlo",'DiscountCurve',myRC,"Model",BlackScholesModel,'SpotPrice',150,'simulationDates',datetime(2022,9,15),'NumTrials',1e3, ... 'MonteCarloMethod',"quasi",'BrownianMotionMethod',"brownian-bridge")

outPricer =

GBMMonteCarlo with properties:

DiscountCurve: [1×1 ratecurve]

SpotPrice: 150

SimulationDates: 15-Sep-2022

NumTrials: 1000

RandomNumbers: []

Model: [1×1 finmodel.BlackScholes]

DividendType: "continuous"

DividendValue: 0

MonteCarloMethod: "quasi"

BrownianMotionMethod: "brownian-bridge"

Price Vanilla Instrument

Use price to compute the price and sensitivities for the Vanilla instrument.

[Price, outPR] = price(outPricer,VanillaOpt,"all")Price = 60.7272

outPR =

priceresult with properties:

Results: [1×7 table]

PricerData: [1×1 struct]

outPR.Results

ans=1×7 table

Price Delta Gamma Lambda Rho Theta Vega

______ _______ _________ ______ ______ _______ ______

60.727 0.92248 0.0024038 2.2786 310.66 -3.7073 39.466

This example shows the workflow to price an American option for a Vanilla instrument when you use a Heston model and an AssetMonteCarlo pricing method.

Create Vanilla Instrument Object

Use fininstrument to create a Vanilla instrument object.

VanillaOpt = fininstrument("Vanilla",'Strike',105,'ExerciseDate',datetime(2022,9,15),'OptionType',"call",'ExerciseStyle',"american",'Name',"vanilla_option")

VanillaOpt =

Vanilla with properties:

OptionType: "call"

ExerciseStyle: "american"

ExerciseDate: 15-Sep-2022

Strike: 105

Name: "vanilla_option"

Create Heston Model Object

Use finmodel to create a Heston model object.

HestonModel = finmodel("Heston",'V0',0.032,'ThetaV',0.07,'Kappa',0.003,'SigmaV',0.02,'RhoSV',0.09)

HestonModel =

Heston with properties:

V0: 0.0320

ThetaV: 0.0700

Kappa: 0.0030

SigmaV: 0.0200

RhoSV: 0.0900

Create ratecurve Object

Create a flat ratecurve object using ratecurve.

Settle = datetime(2018,9,15); Maturity = datetime(2023,9,15); Rate = 0.035; myRC = ratecurve('zero',Settle,Maturity,Rate,'Basis',12)

myRC =

ratecurve with properties:

Type: "zero"

Compounding: -1

Basis: 12

Dates: 15-Sep-2023

Rates: 0.0350

Settle: 15-Sep-2018

InterpMethod: "linear"

ShortExtrapMethod: "next"

LongExtrapMethod: "previous"

Create AssetMonteCarlo Pricer Object

Use finpricer to create an AssetMonteCarlo pricer object and use the ratecurve object for the 'DiscountCurve' name-value pair argument.

outPricer = finpricer("AssetMonteCarlo",'DiscountCurve',myRC,"Model",HestonModel,'SpotPrice',150,'simulationDates',datetime(2022,9,15))

outPricer =

HestonMonteCarlo with properties:

DiscountCurve: [1×1 ratecurve]

SpotPrice: 150

SimulationDates: 15-Sep-2022

NumTrials: 1000

RandomNumbers: []

Model: [1×1 finmodel.Heston]

DividendType: "continuous"

DividendValue: 0

MonteCarloMethod: "standard"

BrownianMotionMethod: "standard"

Price Vanilla Instrument

Use price to compute the price and sensitivities for the Vanilla instrument.

[Price, outPR] = price(outPricer,VanillaOpt,["all"])Price = 60.5637

outPR =

priceresult with properties:

Results: [1×8 table]

PricerData: [1×1 struct]

outPR.Results

ans=1×8 table

Price Delta Gamma Lambda Rho Theta Vega VegaLT

______ _______ _________ ______ ______ _______ ______ _______

60.564 0.94774 0.0011954 2.3473 326.36 -3.7126 35.272 0.31155

This example shows the workflow to price a Bermudan option for a Vanilla instrument when you use a BlackScholes model and a FiniteDifference pricing method.

Create Vanilla Instrument Object

Use fininstrument to create a Vanilla instrument object.

VanillaOpt = fininstrument("Vanilla",'Strike',[110,120],'ExerciseDate',[datetime(2022,9,15) , datetime(2023,9,15)],'OptionType',"call",'ExerciseStyle',"Bermudan",'Name',"vanilla_option")

VanillaOpt =

Vanilla with properties:

OptionType: "call"

ExerciseStyle: "bermudan"

ExerciseDate: [15-Sep-2022 15-Sep-2023]

Strike: [110 120]

Name: "vanilla_option"

Create BlackScholes Model Object

Use finmodel to create a BlackScholes model object.

BlackScholesModel = finmodel("BlackScholes","Volatility",0.2)

BlackScholesModel =

BlackScholes with properties:

Volatility: 0.2000

Correlation: 1

Create ratecurve Object

Create a flat ratecurve object using ratecurve.

Settle = datetime(2018,9,15); Maturity = datetime(2023,9,15); Rate = 0.035; myRC = ratecurve('zero',Settle,Maturity,Rate,'Basis',12)

myRC =

ratecurve with properties:

Type: "zero"

Compounding: -1

Basis: 12

Dates: 15-Sep-2023

Rates: 0.0350

Settle: 15-Sep-2018

InterpMethod: "linear"

ShortExtrapMethod: "next"

LongExtrapMethod: "previous"

Create FiniteDifference Pricer Object

Use finpricer to create a FiniteDifference pricer object and use the ratecurve object for the 'DiscountCurve' name-value pair argument.

outPricer = finpricer("FiniteDifference",'Model',BlackScholesModel,'DiscountCurve',myRC,'SpotPrice',100)

outPricer =

FiniteDifference with properties:

DiscountCurve: [1×1 ratecurve]

Model: [1×1 finmodel.BlackScholes]

SpotPrice: 100

GridProperties: [1×1 struct]

DividendType: "continuous"

DividendValue: 0

Price Vanilla Instrument

Use price to compute the price and sensitivities for the Vanilla instrument.

[Price, outPR] = price(outPricer,VanillaOpt,["all"])Price = 18.6797

outPR =

priceresult with properties:

Results: [1×7 table]

PricerData: [1×1 struct]

outPR.Results

ans=1×7 table

Price Delta Gamma Lambda Theta Rho Vega

_____ _______ _________ ______ _______ ______ ______

18.68 0.62163 0.0091406 3.3278 -3.3154 184.31 83.162

This example shows the workflow to price a Vanilla instrument when you use a Heston model and various pricing methods.

Create Vanilla Instrument Object

Use fininstrument to create a Vanilla instrument object.

Settle = datetime(2017,6,29); Maturity = datemnth(Settle,6); Strike = 80; VanillaOpt = fininstrument('Vanilla','ExerciseDate',Maturity,'Strike',Strike,'Name',"vanilla_option")

VanillaOpt =

Vanilla with properties:

OptionType: "call"

ExerciseStyle: "european"

ExerciseDate: 29-Dec-2017

Strike: 80

Name: "vanilla_option"

Create Heston Model Object

Use finmodel to create a Heston model object.

V0 = 0.04; ThetaV = 0.05; Kappa = 1.0; SigmaV = 0.2; RhoSV = -0.7; HestonModel = finmodel("Heston",'V0',V0,'ThetaV',ThetaV,'Kappa',Kappa,'SigmaV',SigmaV,'RhoSV',RhoSV)

HestonModel =

Heston with properties:

V0: 0.0400

ThetaV: 0.0500

Kappa: 1

SigmaV: 0.2000

RhoSV: -0.7000

Create ratecurve object

Create a ratecurve object using ratecurve.

Rate = 0.03;

ZeroCurve = ratecurve('zero',Settle,Maturity,Rate);Create NumericalIntegration, FFT, and FiniteDifference Pricer Objects

Use finpricer to create a NumericalIntegration, FFT, and FiniteDifference pricer objects and use the ratecurve object for the 'DiscountCurve' name-value pair argument.

SpotPrice = 80; Strike = 80; DividendYield = 0.02; NIPricer = finpricer("NumericalIntegration",'Model', HestonModel,'SpotPrice',SpotPrice,'DiscountCurve',ZeroCurve,'DividendValue',DividendYield)

NIPricer =

NumericalIntegration with properties:

Model: [1×1 finmodel.Heston]

DiscountCurve: [1×1 ratecurve]

SpotPrice: 80

DividendType: "continuous"

DividendValue: 0.0200

AbsTol: 1.0000e-10

RelTol: 1.0000e-10

IntegrationRange: [1.0000e-09 Inf]

CharacteristicFcn: @characteristicFcnHeston

Framework: "heston1993"

VolRiskPremium: 0

LittleTrap: 1

FFTPricer = finpricer("FFT",'Model',HestonModel, ... 'SpotPrice',SpotPrice,'DiscountCurve',ZeroCurve, ... 'DividendValue',DividendYield,'NumFFT',8192)

FFTPricer =

FFT with properties:

Model: [1×1 finmodel.Heston]

DiscountCurve: [1×1 ratecurve]

SpotPrice: 80

DividendType: "continuous"

DividendValue: 0.0200

NumFFT: 8192

CharacteristicFcnStep: 0.0100

LogStrikeStep: 0.0767

CharacteristicFcn: @characteristicFcnHeston

DampingFactor: 1.5000

Quadrature: "simpson"

VolRiskPremium: 0

LittleTrap: 1

FDPricer = finpricer("FiniteDifference",'Model',HestonModel,'SpotPrice',SpotPrice,'DiscountCurve',ZeroCurve,'DividendValue',DividendYield)

FDPricer =

FiniteDifference with properties:

DiscountCurve: [1×1 ratecurve]

Model: [1×1 finmodel.Heston]

SpotPrice: 80

GridProperties: [1×1 struct]

DividendType: "continuous"

DividendValue: 0.0200

Price Vanilla Instrument

Use the following sensitivities when pricing the Vanilla instrument.

InpSensitivity = ["delta", "gamma", "theta", "rho", "vega", "vegalt"];

Use price to compute the price and sensitivities for the Vanilla instrument that uses the NumericalIntegration pricer.

[PriceNI, outPR_NI] = price(NIPricer,VanillaOpt,InpSensitivity)

PriceNI = 4.7007

outPR_NI =

priceresult with properties:

Results: [1×7 table]

PricerData: []

Use price to compute the price and sensitivities for the Vanilla instrument that uses the FFT pricer.

[PriceFFT, outPR_FFT] = price(FFTPricer,VanillaOpt,InpSensitivity)

PriceFFT = 4.7007

outPR_FFT =

priceresult with properties:

Results: [1×7 table]

PricerData: []

Use price to compute the price and sensitivities for the Vanilla instrument that uses the FiniteDifference pricer.

[PriceFD, outPR_FD] = price(FDPricer,VanillaOpt,InpSensitivity)

PriceFD = 4.7003

outPR_FD =

priceresult with properties:

Results: [1×7 table]

PricerData: [1×1 struct]

Aggregate the price results.

[outPR_NI.Results;outPR_FFT.Results;outPR_FD.Results]

ans=3×7 table

Price Delta Gamma Theta Rho Vega VegaLT

______ _______ ________ _______ ______ ______ ______

4.7007 0.57747 0.03392 -4.8474 20.805 17.028 5.2394

4.7007 0.57747 0.03392 -4.8474 20.805 17.028 5.2394

4.7003 0.57722 0.035254 -4.8483 20.801 17.046 5.2422

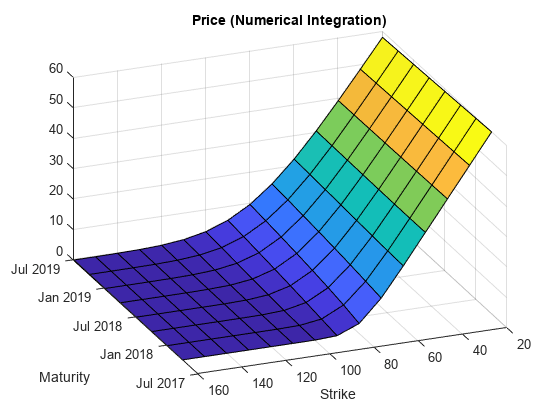

Compute Option Price Surfaces

Use the price function for the NumericalIntegration pricer and the price function for the FFT pricer to compute the prices for a range of Vanilla instruments.

Maturities = datemnth(Settle,(3:3:24)'); NumMaturities = length(Maturities); Strikes = (20:10:160)'; NumStrikes = length(Strikes); [Maturities_Full,Strikes_Full] = meshgrid(Maturities,Strikes); NumInst = numel(Strikes_Full); VanillaOptions(NumInst, 1) = fininstrument("vanilla", ... "ExerciseDate", Maturities_Full(1), "Strike", Strikes_Full(1)); for instidx=1:NumInst VanillaOptions(instidx) = fininstrument("vanilla", ... "ExerciseDate", Maturities_Full(instidx), "Strike", Strikes_Full(instidx)); end Prices_NI = price(NIPricer, VanillaOptions); Prices_FFT = price(FFTPricer, VanillaOptions); figure; surf(Maturities_Full,Strikes_Full,reshape(Prices_NI,[NumStrikes,NumMaturities])); title('Price (Numerical Integration)'); view(-112,34); xlabel('Maturity') ylabel('Strike')

figure; surf(Maturities_Full,Strikes_Full,reshape(Prices_FFT,[NumStrikes,NumMaturities])); title('Price (FFT)'); view(-112,34); xlabel('Maturity') ylabel('Strike')

Since R2024a

This example shows the workflow to price a Vanilla instrument when you use a RoughBergomi model and a RoughVolMonteCarlo pricing method.

Create Vanilla Instrument Object

Use fininstrument to create a Vanilla instrument object.

VanillaOpt = fininstrument("Vanilla",'ExerciseDate',datetime(2019,1,30),'Strike',105,'ExerciseStyle',"european",'Name',"vanilla_option")

VanillaOpt =

Vanilla with properties:

OptionType: "call"

ExerciseStyle: "european"

ExerciseDate: 30-Jan-2019

Strike: 105

Name: "vanilla_option"

Create RoughBergomi Model Object

Use finmodel to create a RoughBergomi model object.

RoughBergomiModel = finmodel("RoughBergomi",Alpha=-0.032,Xi=0.1,Eta=0.003,RhoSV=0.9)RoughBergomiModel =

RoughBergomi with properties:

Alpha: -0.0320

Xi: 0.1000

Eta: 0.0030

RhoSV: 0.9000

Create ratecurve Object

Create a flat ratecurve object using ratecurve.

Settle = datetime(2018,9,15); Maturity = datetime(2023,9,15); Rate = 0.035; myRC = ratecurve('zero',Settle,Maturity,Rate,'Basis',12)

myRC =

ratecurve with properties:

Type: "zero"

Compounding: -1

Basis: 12

Dates: 15-Sep-2023

Rates: 0.0350

Settle: 15-Sep-2018

InterpMethod: "linear"

ShortExtrapMethod: "next"

LongExtrapMethod: "previous"

Create RoughVolMonteCarlo Pricer Object

Use finpricer to create an RoughVolMonteCarlo pricer object and use the ratecurve object for the 'DiscountCurve' name-value pair argument.

outPricer = finpricer("RoughVolMonteCarlo",DiscountCurve=myRC,Model=RoughBergomiModel,SpotPrice=100,SimulationDates=datetime(2019,1,30))outPricer =

RoughBergomiMonteCarlo with properties:

DiscountCurve: [1×1 ratecurve]

SpotPrice: 100

SimulationDates: 30-Jan-2019

NumTrials: 1000

RandomNumbers: []

Model: [1×1 finmodel.RoughBergomi]

DividendType: "continuous"

DividendValue: 0

MonteCarloMethod: "standard"

BrownianMotionMethod: "standard"

Price Vanilla Instrument

Use price to compute the price and sensitivities for the Vanilla instrument.

[Price, outPR] = price(outPricer,VanillaOpt,"all")Price = 7.7862

outPR =

priceresult with properties:

Results: [1×7 table]

PricerData: [1×1 struct]

outPR.Results

ans=1×7 table

Price Delta Gamma Lambda Rho Theta Vega

______ _______ ________ ______ ______ ______ ______

7.7862 0.50369 0.012632 6.469 15.947 1.0273 30.741

Since R2024b

This example shows the workflow to price a Vanilla instrument when you use a RoughHeston model and a RoughVolMonteCarlo pricing method.

Create Vanilla Instrument Object

Use fininstrument to create a Vanilla instrument object.

VanillaOpt = fininstrument("Vanilla",'ExerciseDate',datetime(2019,1,30),'Strike',105,'ExerciseStyle',"european",'Name',"vanilla_option")

VanillaOpt =

Vanilla with properties:

OptionType: "call"

ExerciseStyle: "european"

ExerciseDate: 30-Jan-2019

Strike: 105

Name: "vanilla_option"

Create RoughHeston Model Object

Use finmodel to create a RoughHeston model object.

RoughBergomiModel = finmodel("RoughHeston",V0=0.4,ThetaV=0.3,Kappa=0.2,SigmaV=0.1,Alpha=-0.02,RhoSV=0.3)RoughBergomiModel =

RoughHeston with properties:

Alpha: -0.0200

V0: 0.4000

ThetaV: 0.3000

Kappa: 0.2000

SigmaV: 0.1000

RhoSV: 0.3000

Create ratecurve Object

Create a flat ratecurve object using ratecurve.

Settle = datetime(2018,9,15); Maturity = datetime(2023,9,15); Rate = 0.035; myRC = ratecurve('zero',Settle,Maturity,Rate,'Basis',12)

myRC =

ratecurve with properties:

Type: "zero"

Compounding: -1

Basis: 12

Dates: 15-Sep-2023

Rates: 0.0350

Settle: 15-Sep-2018

InterpMethod: "linear"

ShortExtrapMethod: "next"

LongExtrapMethod: "previous"

Create RoughVolMonteCarlo Pricer Object

Use finpricer to create an RoughVolMonteCarlo pricer object and use the ratecurve object for the 'DiscountCurve' name-value argument.

outPricer = finpricer("RoughVolMonteCarlo",DiscountCurve=myRC,Model=RoughBergomiModel,SpotPrice=100,SimulationDates=datetime(2019,1,30))outPricer =

RoughHestonMonteCarlo with properties:

DiscountCurve: [1×1 ratecurve]

SpotPrice: 100

SimulationDates: 30-Jan-2019

NumTrials: 1000

RandomNumbers: []

Model: [1×1 finmodel.RoughHeston]

DividendType: "continuous"

DividendValue: 0

MonteCarloMethod: "standard"

BrownianMotionMethod: "standard"

Price Vanilla Instrument

Use price to compute the price and sensitivities for the Vanilla instrument.

[Price, outPR] = price(outPricer,VanillaOpt,"all")Price = 13.9392

outPR =

priceresult with properties:

Results: [1×8 table]

PricerData: [1×1 struct]

outPR.Results

ans=1×8 table

Price Delta Gamma Lambda Rho Theta Vega VegaLT

______ _______ ________ ______ ______ _______ ______ ______

13.939 0.54193 0.011253 3.8878 15.143 -22.098 24.539 0

More About

A vanilla option is a category of options that includes only the most standard components.

A vanilla option is based on an underlying asset, which can include stocks, bonds, commodities, currencies, or market indices. The value of the option is derived from the price movement of the underlying asset.

Vanilla options come in two forms: call options and put options. A call option gives the holder the right to buy the underlying asset at the strike price, while a put option gives the holder the right to sell the underlying asset at the strike price. The buyer of a vanilla option pays a premium to the seller or writer of the option in exchange for the rights provided by the option contract. The premium represents the cost of acquiring the option and is influenced by factors such as the price of the underlying asset, time to expiration, volatility, and prevailing market conditions.

The strike price, also known as the exercise price, is the predetermined price at which the underlying asset can be bought (in the case of a call option) or sold (in the case of a put option) if the option is exercised.

A vanilla option has an expiration date and straightforward strike price. After the expiration date, the option becomes void. American-style options and European-style options are both categorized as vanilla options.

The payoff for a vanilla option is as follows:

For a call:

For a put:

where:

St is the price of the underlying asset at time t.

K is the strike price.

For more information, see Vanilla Option.

Tips

After creating a Vanilla instrument object, you can use setExercisePolicy to

change the size of the options. For example, if you have the following

instrument:

VanillaOpt = fininstrument("Vanilla",'ExerciseDate',datetime(2021,5,1),'Strike',29,'OptionType',"put",'ExerciseStyle',"European")Vanilla instrument's size by changing the

ExerciseStyle from "European" to

"American", use setExercisePolicy:VanillaOpt = setExercisePolicy(VanillaOpt,[datetime(2021,1,1) datetime(2022,1,1)],100,'American')

Version History

Introduced in R2020aThe Vanilla instrument object supports pricing with a RoughHeston model and

a RoughVolMonteCarlo pricing method.

The Vanilla instrument object supports pricing with a RoughBergomi model

and a RoughVolMonteCarlo pricing method.

Although Vanilla supports serial date numbers,

datetime values are recommended instead. The

datetime data type provides flexible date and time

formats, storage out to nanosecond precision, and properties to account for time

zones and daylight saving time.

To convert serial date numbers or text to datetime values, use the datetime function. For example:

t = datetime(738427.656845093,"ConvertFrom","datenum"); y = year(t)

y =

2021

There are no plans to remove support for serial date number inputs.

See Also

Functions

Topics

- Price European Vanilla Call Options Using Black-Scholes Model and Different Equity Pricers

- Use Black-Scholes Model to Price Asian Options with Several Equity Pricers

- Get Started with Workflows Using Object-Based Framework for Pricing Financial Instruments

- Choose Instruments, Models, and Pricers

- Supported Exercise Styles

MATLAB Command

You clicked a link that corresponds to this MATLAB command:

Run the command by entering it in the MATLAB Command Window. Web browsers do not support MATLAB commands.

Website auswählen

Wählen Sie eine Website aus, um übersetzte Inhalte (sofern verfügbar) sowie lokale Veranstaltungen und Angebote anzuzeigen. Auf der Grundlage Ihres Standorts empfehlen wir Ihnen die folgende Auswahl: .

Sie können auch eine Website aus der folgenden Liste auswählen:

So erhalten Sie die bestmögliche Leistung auf der Website

Wählen Sie für die bestmögliche Website-Leistung die Website für China (auf Chinesisch oder Englisch). Andere landesspezifische Websites von MathWorks sind für Besuche von Ihrem Standort aus nicht optimiert.

Amerika

- América Latina (Español)

- Canada (English)

- United States (English)

Europa

- Belgium (English)

- Denmark (English)

- Deutschland (Deutsch)

- España (Español)

- Finland (English)

- France (Français)

- Ireland (English)

- Italia (Italiano)

- Luxembourg (English)

- Netherlands (English)

- Norway (English)

- Österreich (Deutsch)

- Portugal (English)

- Sweden (English)

- Switzerland

- United Kingdom (English)