price2ret

Convert prices to returns

Syntax

Description

ReturnTbl = price2ret(PriceTbl)DataVariables name-value argument. (since R2022a)

[___] = price2ret(___,

specifies options using one or more name-value arguments in

addition to any of the input argument combinations in previous syntaxes.

Name=Value)price2ret returns the output argument combination for the

corresponding input arguments. For example,

price2ret(Tbl,Method="periodic",DataVariables=1:5) computes the simple

periodic returns of the first five variables in the input table

Tbl. (since R2022a)

Examples

Load the Schwert Stock data set Data_SchwertStock.mat, which contains daily prices of the S&P index from 1930 through 2008, among other variables (enter Description for more details).

load Data_SchwertStock

numObs = height(DataTableDly)numObs = 20838

dates = datetime(datesDly,ConvertFrom="datenum");Convert the S&P price series to returns.

prices = DataTableDly.SP; returns = price2ret(prices);

returns is a 20837-by-1 vector of daily S&P returns compounded continuously.

r9 = returns(9)

r9 = 0.0033

p9_10 = [prices(9) prices(10)]

p9_10 = 1×2

21.4500 21.5200

returns(9) = 0.0033 is the daily return of the prices in the interval [21.45, 21.52].

plot(dates,DataTableDly.SP) ylabel("Price") yyaxis right plot(dates(1:end-1),returns) ylabel("Return") title("S&P Index Prices and Returns")

Since R2022a

Convert the price series in a table to simple periodic return series.

Load the US equity indices data set, which contains the table DataTable of daily closing prices of the NYSE and NASDAQ composite indices from 1990 through 2011.

load Data_EquityIdxCreate a timetable from the table.

dates = datetime(dates,ConvertFrom="datenum");

TT = table2timetable(DataTable,RowTimes=dates);

numObs = height(TT);Convert the NASDAQ and NYSE prices to simple periodic and continuously compounded returns.

varnames = ["NASDAQ" "NYSE"]; TTRetC = price2ret(TT,DataVariables=varnames); TTRetP = price2ret(TT,DataVariables=varnames,Method="periodic");

Because TT is a timetable, TTRetC and TTRetP are timetables.

Plot the return series with the corresponding prices for the last 50 observations.

idx = ((numObs - 1) - 51):(numObs - 1); figure plot(dates(idx + 1),TT.NYSE(idx + 1)) title("NYSE Index Prices and Returns") ylabel("Price") yyaxis right h = plot(dates(idx),[TTRetC.NYSE(idx) TTRetP.NYSE(idx)]); h(2).Marker = 'o'; h(2).Color = 'k'; ylabel("Return") legend(["Price" "Continuous" "Periodic"],Location="northwest") axis tight

figure plot(dates(idx + 1),TT.NASDAQ(idx + 1)) title("NASDAQ Index Prices and Returns") ylabel("Price") yyaxis right h = plot(dates(idx),[TTRetC.NASDAQ(idx) TTRetP.NASDAQ(idx)]); h(2).Marker = 'o'; h(2).Color = 'k'; ylabel("Return") legend(["Price" "Continuous" "Periodic"],Location="northwest") axis tight

In this case, the simple periodic and continuously compounded returns of each price series are similar.

Since R2022a

Create two stock price series from continuously compounded returns that have the following characteristics:

Series 1 grows at a 10 percent rate at each observation time.

Series 2 changes at a random uniform rate in the interval [-0.1, 0.1] at each observation time.

Each series starts at price 100 and is 10 observations in length.

rng(1); % For reproducibility

numObs = 10;

p1 = 100;

r1 = 0.10;

r2 = [0; unifrnd(-0.10,0.10,numObs - 1,1)];

s1 = 100*exp(r1*(0:(numObs - 1))');

cr2 = cumsum(r2);

s2 = 100*exp(cr2);

S = [s1 s2];Convert each price series to a return series, and return the observation intervals.

[R,intervals] = price2ret(S);

Prepend the return series so that the input and output elements are of the same length and correspond.

[[NaN; intervals] S [[NaN NaN]; R] r2]

ans = 10×6

NaN 100.0000 100.0000 NaN NaN 0

1.0000 110.5171 98.3541 0.1000 -0.0166 -0.0166

1.0000 122.1403 102.7850 0.1000 0.0441 0.0441

1.0000 134.9859 93.0058 0.1000 -0.1000 -0.1000

1.0000 149.1825 89.4007 0.1000 -0.0395 -0.0395

1.0000 164.8721 83.3026 0.1000 -0.0706 -0.0706

1.0000 182.2119 76.7803 0.1000 -0.0815 -0.0815

1.0000 201.3753 72.1105 0.1000 -0.0627 -0.0627

1.0000 222.5541 69.9172 0.1000 -0.0309 -0.0309

1.0000 245.9603 68.4885 0.1000 -0.0206 -0.0206

price2ret returns rates matching the rates from the simulated series. price2ret assumes prices are recorded in a regular time base. Therefore, all durations between prices are 1.

Convert the prices to returns again, but associate the prices with years starting from August 1, 2010.

tau1 = datetime(2010,08,01); dates = tau1 + years((0:(numObs-1))'); [Ry,intervalsy] = price2ret(S,Ticks=dates); [[NaN; intervalsy] S [[NaN NaN]; Ry] r2]

ans = 10×6

NaN 100.0000 100.0000 NaN NaN 0

365.2425 110.5171 98.3541 0.0003 -0.0000 -0.0166

365.2425 122.1403 102.7850 0.0003 0.0001 0.0441

365.2425 134.9859 93.0058 0.0003 -0.0003 -0.1000

365.2425 149.1825 89.4007 0.0003 -0.0001 -0.0395

365.2425 164.8721 83.3026 0.0003 -0.0002 -0.0706

365.2425 182.2119 76.7803 0.0003 -0.0002 -0.0815

365.2425 201.3753 72.1105 0.0003 -0.0002 -0.0627

365.2425 222.5541 69.9172 0.0003 -0.0001 -0.0309

365.2425 245.9603 68.4885 0.0003 -0.0001 -0.0206

price2ret assumes time units are days. Therefore, all durations are approximately 365 and the returns are normalized for that time unit.

Compute returns again, but specify that the observation times are years.

[Ryy,intervalsyy] = price2ret(S,Ticks=dates,Units="years");

[[NaN; intervalsyy] S [[NaN NaN]; Ryy] r2]ans = 10×6

NaN 100.0000 100.0000 NaN NaN 0

1.0000 110.5171 98.3541 0.1000 -0.0166 -0.0166

1.0000 122.1403 102.7850 0.1000 0.0441 0.0441

1.0000 134.9859 93.0058 0.1000 -0.1000 -0.1000

1.0000 149.1825 89.4007 0.1000 -0.0395 -0.0395

1.0000 164.8721 83.3026 0.1000 -0.0706 -0.0706

1.0000 182.2119 76.7803 0.1000 -0.0815 -0.0815

1.0000 201.3753 72.1105 0.1000 -0.0627 -0.0627

1.0000 222.5541 69.9172 0.1000 -0.0309 -0.0309

1.0000 245.9603 68.4885 0.1000 -0.0206 -0.0206

price2ret normalizes the returns relative to years, and now the returned rates match the simulated rates.

Input Arguments

Time series of prices, specified as a

numObs-by-numVars numeric matrix. Each row of

Prices corresponds to an observation time specified by the optional

Ticks name-value argument. Each column of

Prices corresponds to an individual price series.

Data Types: double

Since R2022a

Time series of prices, specified as a table or timetable with

numObs rows. Each row of Tbl is an observation

time. For a table, the optional Ticks name-value argument specifies

observation times. For a timetable, PriceTbl.Time specifies

observation times and it must be a datetime vector.

Specify numVars variables, from which to compute returns, by

using the DataVariables argument. The selected variables must be

numeric.

Name-Value Arguments

Specify optional pairs of arguments as

Name1=Value1,...,NameN=ValueN, where Name is

the argument name and Value is the corresponding value.

Name-value arguments must appear after other arguments, but the order of the

pairs does not matter.

Before R2021a, use commas to separate each name and value, and enclose

Name in quotes.

Example: price2ret(Tbl,Method="periodic",DataVariables=1:5) computes

the simple periodic returns of the first five variables in the input table

Tbl.

Since R2022a

Observation times τ, specified as a length

numObs numeric or datetime vector of increasing values.

When the input price series are in a matrix or table, the default is

1:numObs.

When the input price series are in a timetable, price2ret

uses the row times in PriceTbl.Time and ignores

Ticks. PriceTbl.Time must be a datetime

vector.

Example: Ticks=datetime(1950:2020,12,31) specifies the end of

each year from 1950 through 2020.

Example: Ticks=datetime(1950,03,31):calquarters(1):datetime(2020,12,31)

specifies the end of each quarter during the years 1950 through 2020.

Data Types: double | datetime

Since R2022a

Time units to use when observation times Ticks are datetimes,

specified as a value in this table.

| Value | Description |

|---|---|

"milliseconds" | Milliseconds |

"seconds" | Seconds |

"minutes" | Minutes |

"hours" | Hours |

"days" | Days |

"years" | Years |

price2ret requires time units to convert duration intervals

to numeric values for normalizing returns.

When the value of the Ticks name-value argument is a numeric

vector, price2ret ignores the value of

Units.

Example: Units="years"

Data Types: char | string

Since R2022a

Compounding method, specified as a value in this table.

| Value | Description |

|---|---|

"continuous" | Compute continuously compounded returns |

"periodic" | Compute simple periodic returns |

Example: Method="periodic"

Data Types: char | string

Since R2022a

Variables in PriceTbl, from which

price2ret computes returns, specified as a string vector or

cell vector of character vectors containing variable names in

PriceTbl.Properties.VariableNames, or an integer or logical

vector representing the indices of names. The selected variables must be

numeric.

Example: DataVariables=["GDP" "CPI"]

Example: DataVariables=[true true false false] or

DataVariables=[1 2] selects the first and second table

variables.

Data Types: double | logical | char | cell | string

Output Arguments

Return series, returned as a (numObs –

1)-by-numVars numeric matrix. price2ret

returns Returns when you supply the input

Prices.

Returns in row i

ri are associated with price interval

[pi,pi+1],

i = 1:(numObs - 1), according to the compounding

method Method:

When

Methodis"continuous",When

Methodis"periodic",

When observation times τ (see

Ticks) are datetimes, the magnitude of the normalizing interval

τi+1 –

τi depends on the specified time units

(see Units).

Since R2022a

Return series and time intervals, returned as a table or timetable, the same data

type as PriceTbl, with numObs – 1 rows.

price2ret returns ReturnTbl when you

supply the input PriceTbl.

ReturnTbl contains the outputs Returns and

intervals.

ReturnTbl associates observation time

τi+1 with the end of

the interval for the returns in row i

ri.

Algorithms

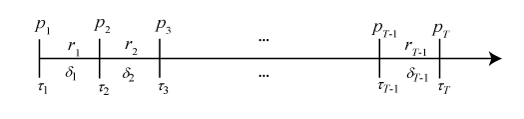

Consider the following variables:

The following figure shows how the inputs and outputs are associated.

Version History

Introduced before R2006aWhen you use the optional positional inputs of price2ret to

specify observation times and the compounding method, MATLAB® issues an error stating that the syntaxes are removed. To avoid the error,

replace the optional positional inputs by using the Name=Value argument

syntax.

This syntax specifies optional positional inputs and issues an error.

price2ret(Prices,ticktimes,method)

price2ret(Prices,Ticks=ticktimes,Method=method)

When you use the optional positional inputs of price2ret to

specify observation times and the compounding method, MATLAB issues a warning stating that the syntax will be removed. To avoid the

warning, replace the optional positional inputs by using the Name=Value

argument syntax.

This syntax specifies optional positional inputs and issues a warning.

price2ret(Prices,ticktimes,method)

price2ret(Prices,Ticks=ticktimes,Method=method)

The optional positional inputs of price2ret that specify

observation times and the compounding method will be removed. To replace the optional

positional inputs, use the Name=Value argument syntax.

This syntax specifies optional positional inputs and is being removed.

price2ret(Prices,ticktimes,method)

price2ret(Prices,Ticks=ticktimes,Method=method)

Instead of using the optional positional inputs of price2ret to

specify the observation times and compounding method, use the Name=Value

argument syntax.

This syntax specifies the optional positional inputs before R2022a.

price2ret(Prices,ticktimes,method)

This syntax is the recommended replacement for R2022a and later releases.

price2ret(Prices,Ticks=ticktimes,Method=method)

In addition to accepting input data in numeric arrays, price2ret accepts input data in tables and timetables. When you supply data in a table or timetable, the following conditions apply:

price2retchooses default series on which to operate, but you can use theDataVariablesname-value argument to select variables.price2retreturns results in tables or timetables.

To convert duration intervals to numeric values for normalizing returns,

price2ret enables you to specify time units of the observation

datetimes in Ticks by using the Units name-value

argument.

MATLAB Command

You clicked a link that corresponds to this MATLAB command:

Run the command by entering it in the MATLAB Command Window. Web browsers do not support MATLAB commands.

Website auswählen

Wählen Sie eine Website aus, um übersetzte Inhalte (sofern verfügbar) sowie lokale Veranstaltungen und Angebote anzuzeigen. Auf der Grundlage Ihres Standorts empfehlen wir Ihnen die folgende Auswahl: .

Sie können auch eine Website aus der folgenden Liste auswählen:

So erhalten Sie die bestmögliche Leistung auf der Website

Wählen Sie für die bestmögliche Website-Leistung die Website für China (auf Chinesisch oder Englisch). Andere landesspezifische Websites von MathWorks sind für Besuche von Ihrem Standort aus nicht optimiert.

Amerika

- América Latina (Español)

- Canada (English)

- United States (English)

Europa

- Belgium (English)

- Denmark (English)

- Deutschland (Deutsch)

- España (Español)

- Finland (English)

- France (Français)

- Ireland (English)

- Italia (Italiano)

- Luxembourg (English)

- Netherlands (English)

- Norway (English)

- Österreich (Deutsch)

- Portugal (English)

- Sweden (English)

- Switzerland

- United Kingdom (English)