hpfilter

Hodrick-Prescott filter for trend and cyclical components

Syntax

Description

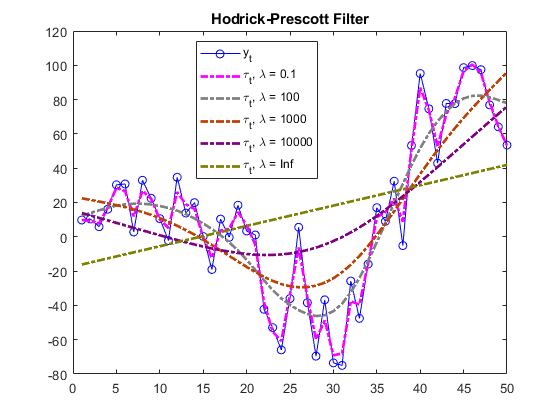

The hpfilter function applies the Hodrick-Prescott filter to

separate one or more time series into additive trend and cyclical components.

hpfilter optionally plots the series and trend component, with

cycles removed. The plot helps you select a smoothing parameter.

In addition to the Hodrick-Prescott filter, Econometrics Toolbox™ supports the Baxter-King (bkfilter),

Christiano-Fitzgerald (cffilter), and

Hamilton (hfilter)

filters.

[

returns tables or timetables containing variables for the trend and cyclical components

from applying the Hodrick-Prescott filter to each variable in the input table or

timetable. To select different variables to filter, use the

TTbl,CTbl] = hpfilter(Tbl)DataVariables name-value argument. (since R2022a)

[___] = hpfilter(___,

specifies options using one or more name-value arguments in

addition to any of the input argument combinations in previous syntaxes.

Name=Value)hpfilter returns the output argument combination for the

corresponding input arguments. For example,

hpfilter(Tbl,Smoothing=100,DataVariables=1:5) applies the

Hodrick-Prescott filter to the first five variables in the input table

Tbl and sets the smoothing parameter to

100. (since R2022a)

hpfilter(___) plots time series variables in the

input data and their respective trend components, computed by the Hodrick-Prescott filter,

on the same axes.

hpfilter(

plots on the axes specified by ax,___)ax instead of

the current axes (gca). ax can precede any of the input

argument combinations in the previous syntaxes. (since R2022a)

Examples

Input Arguments

Name-Value Arguments

Output Arguments

More About

Tips

Hodrick and Prescott [1] suggest values for the smoothing parameter λ (

Smoothing) that depend upon the periodicity of the data, and Ravn and Uhlig [3] suggest adjustments to those values. This table contains their suggested smoothing parameter values for several data periodicities.Periodicity Hodrick and Prescott Suggested SmoothingRavn and Uhlig Suggested SmoothingYearly 100 6.25 Quarterly 1600 1600 Monthly 14400 129600 Supply a vector of smoothing parameters for the

Smoothingname-value argument to test alternatives. Plot the results to visually compare the alternatives.The default two-sided filter (see

FilterType) uses future values of the input series to compute outputs at time t. Because the filter is typically applied to historical data, the results can contain anomalous end effects unsuitable for forecasting [4]. The one-sided filter, by contrast, is causal because it uses only current and previous values of the input series. As a result, the one-sided filter does not revise outputs when new data becomes available.

Algorithms

hpfilter implements the closed-form solution in [2], Appendix A to the original Hodrick-Prescott programming problem [1].

Therefore, hpfilter requires complete data and removes

NaN values in the input data by using listwise deletion.

References

[1] Hodrick, Robert J., and Edward C. Prescott. "Postwar U.S. Business Cycles: An Empirical Investigation." Journal of Money, Credit and Banking 29, no. 1 (February 1997): 1–16. https://doi.org/10.2307/2953682.