egarch

EGARCH conditional variance time series model

Description

Use egarch to specify a univariate EGARCH (exponential generalized autoregressive conditional heteroscedastic) model. The egarch function returns an egarch object specifying the functional form of an EGARCH(P,Q) model, and stores its parameter values.

The key components of an egarch model include the:

GARCH polynomial, which is composed of lagged, logged conditional variances. The degree is denoted by P.

ARCH polynomial, which is composed of the magnitudes of lagged standardized innovations.

Leverage polynomial, which is composed of lagged standardized innovations.

Maximum of the ARCH and leverage polynomial degrees, denoted by Q.

P is the maximum nonzero lag in the GARCH polynomial, and Q is the maximum nonzero lag in the ARCH and leverage polynomials. Other model components include an innovation mean model offset, a conditional variance model constant, and the innovations distribution.

All coefficients are unknown (NaN values) and estimable unless you specify their values using name-value pair argument syntax. To estimate models containing all or partially unknown parameter values given data, use estimate. For completely specified models (models in which all parameter values are known), simulate or forecast responses using simulate or forecast, respectively.

Creation

Description

Mdl = egarchegarch object.

Mdl = egarch(P,Q)Mdl) with a GARCH polynomial with a degree of P, and ARCH and leverage polynomials each with a degree of Q. All polynomials contain all consecutive lags from 1 through their degrees, and all coefficients are NaN values.

This shorthand syntax enables you to create a template in which you specify the polynomial degrees explicitly. The model template is suited for unrestricted parameter estimation, that is, estimation without any parameter equality constraints. However, after you create a model, you can alter property values using dot notation.

Mdl = egarch(Name,Value)'ARCHLags',[1 4],'ARCH',{0.2 0.3} specifies the two ARCH coefficients in ARCH at lags 1 and 4.

This longhand syntax enables you to create more flexible models.

Input Arguments

The shorthand syntax provides an easy way for you to create model templates that are suitable for unrestricted parameter estimation. For example, to create an EGARCH(1,2) model containing unknown parameter values, enter:

Mdl = egarch(1,2);

GARCH polynomial degree, specified as a nonnegative integer. In the GARCH polynomial and at time t, MATLAB® includes all consecutive logged conditional variance terms from lag t – 1 through lag t – P.

You can specify this argument using the

egarch(P,Q) shorthand syntax only.

If P > 0, then you must specify Q as a positive integer.

Example: egarch(1,1)

Data Types: double

ARCH polynomial degree, specified as a nonnegative integer. In the ARCH polynomial and at time t, MATLAB includes all consecutive magnitudes of standardized innovation terms (for the ARCH polynomial) and all standardized innovation terms (for the leverage polynomial) from lag t – 1 through lag t – Q.

You can specify this argument using the

egarch(P,Q) shorthand syntax only.

If P > 0, then you must specify Q as a positive integer.

Example: egarch(1,1)

Data Types: double

Name-Value Arguments

Specify optional pairs of arguments as

Name1=Value1,...,NameN=ValueN, where Name is

the argument name and Value is the corresponding value.

Name-value arguments must appear after other arguments, but the order of the

pairs does not matter.

Before R2021a, use commas to separate each name and value, and enclose

Name in quotes.

The longhand syntax

enables you to create models in which some or all coefficients are known. During estimation,

estimate imposes equality constraints on any known parameters.

Example: 'ARCHLags',[1 4],'ARCH',{NaN NaN} specifies an EGARCH(0,4) model and unknown, but nonzero, ARCH coefficient matrices at lags 1 and 4.

GARCH polynomial lags, specified as the comma-separated pair consisting of

'GARCHLags' and a numeric vector of unique positive

integers.

GARCHLags( is the lag corresponding to

the coefficient j)GARCH{. The lengths of

j}GARCHLags and GARCH must be equal.

Assuming all GARCH coefficients (specified by the GARCH property)

are positive or NaN values, max(GARCHLags)

determines the value of the P property.

Example: 'GARCHLags',[1 4]

Data Types: double

ARCH polynomial lags, specified as the comma-separated pair consisting of

'ARCHLags' and a numeric vector of unique positive

integers.

ARCHLags( is the lag corresponding to

the coefficient j)ARCH{. The lengths of

j}ARCHLags and ARCH must be equal.

Assuming all ARCH and leverage coefficients (specified by the

ARCH and Leverage properties) are positive

or NaN values, max([ARCHLags LeverageLags])

determines the value of the Q property.

Example: 'ARCHLags',[1 4]

Data Types: double

Leverage polynomial lags, specified as the comma-separated pair consisting of

'LeverageLags' and a numeric vector of unique positive

integers.

LeverageLags( is the lag corresponding

to the coefficient j)Leverage{. The

lengths of j}LeverageLags and Leverage must be

equal.

Assuming all ARCH and leverage coefficients (specified by the

ARCH and Leverage properties) are positive

or NaN values, max([ARCHLags LeverageLags])

determines the value of the Q property.

Example: 'LeverageLags',1:4

Data Types: double

Properties

You can set writable property values when you create the model object by using name-value argument syntax, or after you create the model object by using dot notation. For example, to create an EGARCH(1,1) model with unknown coefficients, and then specify a t innovation distribution with unknown degrees of freedom, enter:

Mdl = egarch('GARCHLags',1,'ARCHLags',1);

Mdl.Distribution = "t";This property is read-only.

GARCH polynomial degree, specified as a nonnegative integer. P is

the maximum lag in the GARCH polynomial with a coefficient that is positive or

NaN. Lags that are less than P can have

coefficients equal to 0.

P specifies the minimum number of presample conditional variances

required to initialize the model.

If you use name-value pair arguments to create the model, then MATLAB implements one of these alternatives (assuming the coefficient of the

largest lag is positive or NaN):

If you specify

GARCHLags, thenPis the largest specified lag.If you specify

GARCH, thenPis the number of elements of the specified value. If you also specifyGARCHLags, thenegarchusesGARCHLagsto determinePinstead.Otherwise,

Pis0.

Data Types: double

This property is read-only.

Maximum degree of ARCH and leverage polynomials, specified as a nonnegative integer.

Q is the maximum lag in the ARCH and leverage polynomials in the

model. In either type of polynomial, lags that are less than Q can

have coefficients equal to 0.

Q specifies the minimum number of presample innovations required to

initiate the model.

If you use name-value pair arguments to create the model, then MATLAB implements one of these alternatives (assuming the coefficients of the

largest lags in the ARCH and leverage polynomials are positive or NaN):

If you specify

ARCHLagsorLeverageLags, thenQis the maximum between the two specifications.If you specify

ARCHorLeverage, thenQis the maximum number of elements between the two specifications. If you also specifyARCHLagsorLeverageLags, thenegarchuses their values to determineQinstead.Otherwise,

Qis0.

Data Types: double

Conditional variance model constant, specified as a numeric scalar or NaN value.

Data Types: double

GARCH polynomial coefficients, specified as a cell vector of positive scalars or NaN values.

If you specify

GARCHLags, then the following conditions apply.The lengths of

GARCHandGARCHLagsare equal.GARCH{is the coefficient of lagj}GARCHLags(.j)By default,

GARCHis anumel(GARCHLags)-by-1 cell vector ofNaNvalues.

Otherwise, the following conditions apply.

The length of

GARCHisP.GARCH{is the coefficient of lagj}j.By default,

GARCHis aP-by-1 cell vector ofNaNvalues.

The coefficients in GARCH correspond to coefficients in an underlying LagOp lag operator polynomial, and are subject to a near-zero tolerance exclusion test. If you set a coefficient to 1e–12 or below, egarch excludes that coefficient and its corresponding lag in GARCHLags from the model.

Data Types: cell

ARCH polynomial coefficients, specified as a cell vector of positive scalars or NaN values.

If you specify

ARCHLags, then the following conditions apply.The lengths of

ARCHandARCHLagsare equal.ARCH{is the coefficient of lagj}ARCHLags(.j)By default,

ARCHis aQ-by-1 cell vector ofNaNvalues. For more details, see theQproperty.

Otherwise, the following conditions apply.

The length of

ARCHisQ.ARCH{is the coefficient of lagj}j.By default,

ARCHis aQ-by-1 cell vector ofNaNvalues.

The coefficients in ARCH correspond to coefficients in an underlying LagOp lag operator polynomial, and are subject to a near-zero tolerance exclusion test. If you set a coefficient to 1e–12 or below, egarch excludes that coefficient and its corresponding lag in ARCHLags from the model.

Data Types: cell

Leverage polynomial coefficients, specified as a cell vector of numeric scalars or NaN values.

If you specify

LeverageLags, then the following conditions apply.The lengths of

LeverageandLeverageLagsare equal.Leverage{is the coefficient of lagj}LeverageLags(.j)By default,

Leverageis aQ-by-1 cell vector ofNaNvalues. For more details, see theQproperty.

Otherwise, the following conditions apply.

The length of

LeverageisQ.Leverage{is the coefficient of lagj}j.By default,

Leverageis aQ-by-1 cell vector ofNaNvalues.

The coefficients in Leverage correspond to coefficients in an underlying LagOp lag operator polynomial, and are subject to a near-zero tolerance exclusion test. If you set a coefficient to 1e–12 or below, egarch excludes that coefficient and its corresponding lag in LeverageLags from the model.

Data Types: cell

This property is read-only.

The model unconditional variance, specified as a positive scalar.

The unconditional variance is

κ is the conditional variance model constant (Constant).

Data Types: double

Innovation mean model offset, or additive constant, specified as a numeric scalar or NaN value.

Data Types: double

Conditional probability distribution of the innovation process

εt, specified as a string or structure

array. egarch stores the value as a structure array.

| Distribution | String | Structure Array |

|---|---|---|

| Gaussian | "Gaussian" | struct('Name',"Gaussian") |

| Student’s t | "t" | struct('Name',"t",'DoF',DoF) |

The 'DoF' field specifies the t distribution

degrees of freedom parameter.

DoF> 2 orDoF=NaN.DoFis estimable.If you specify

"t",DoFisNaNby default. You can change its value by using dot notation after you create the model. For example,Mdl.Distribution.DoF = 3.If you supply a structure array to specify the Student's t distribution, then you must specify both the

'Name'and the'DoF'fields.

Example: Distribution=struct('Name',"t",'DoF',10)

Model description, specified as a string scalar or character vector. egarch stores the value as a string scalar. The default value describes the parametric form of the model, for example

"EGARCH(1,1) Conditional Variance Model (Gaussian

Distribution)".

Data Types: string | char

Since R2023a

Response series name, specified as a string scalar or character vector.

egarch stores the value as a string scalar.

Example: "StockReturn"

Data Types: string | char

Note

All

NaN-valued model parameters, which include coefficients and the t-innovation-distribution degrees of freedom (if present), are estimable. When you pass the resultingegarchobject and data toestimate, MATLAB estimates allNaN-valued parameters. During estimation,estimatetreats known parameters as equality constraints, that is,estimateholds any known parameters fixed at their values.Typically, the lags in the ARCH and leverage polynomials are the same, but their equality is not a requirement. Differing polynomials occur when:

Either

ARCH{Q}orLeverage{Q}meets the near-zero exclusion tolerance. In this case, MATLAB excludes the corresponding lag from the polynomial.You specify polynomials of differing lengths by specifying

ARCHLagsorLeverageLags, or by setting theARCHorLeverageproperty.

In either case,

Qis the maximum lag between the two polynomials.

Object Functions

estimate | Fit conditional variance model to data |

filter | Filter disturbances through conditional variance model |

forecast | Forecast conditional variances from conditional variance models |

infer | Infer conditional variances of conditional variance models |

simulate | Monte Carlo simulation of conditional variance models |

summarize | Display estimation results of conditional variance model |

Examples

Create a default egarch model object and specify its parameter values using dot notation.

Create an EGARCH(0,0) model.

Mdl = egarch

Mdl =

egarch with properties:

Description: "EGARCH(0,0) Conditional Variance Model (Gaussian Distribution)"

SeriesName: "Y"

Distribution: Name = "Gaussian"

P: 0

Q: 0

Constant: NaN

GARCH: {}

ARCH: {}

Leverage: {}

Offset: 0

Mdl is an egarch model. It contains an unknown constant, its offset is 0, and the innovation distribution is 'Gaussian'. The model does not have GARCH, ARCH, or leverage polynomials.

Specify two unknown ARCH and leverage coefficients for lags one and two using dot notation.

Mdl.ARCH = {NaN NaN};

Mdl.Leverage = {NaN NaN};

MdlMdl =

egarch with properties:

Description: "EGARCH(0,2) Conditional Variance Model (Gaussian Distribution)"

SeriesName: "Y"

Distribution: Name = "Gaussian"

P: 0

Q: 2

Constant: NaN

GARCH: {}

ARCH: {NaN NaN} at lags [1 2]

Leverage: {NaN NaN} at lags [1 2]

Offset: 0

The Q, ARCH, and Leverage properties update to 2, {NaN NaN}, {NaN NaN}, respectively. The two ARCH and leverage coefficients are associated with lags 1 and 2.

Create an egarch model object using the shorthand notation egarch(P,Q), where P is the degree of the GARCH polynomial and Q is the degree of the ARCH and leverage polynomial.

Create an EGARCH(3,2) model.

Mdl = egarch(3,2)

Mdl =

egarch with properties:

Description: "EGARCH(3,2) Conditional Variance Model (Gaussian Distribution)"

SeriesName: "Y"

Distribution: Name = "Gaussian"

P: 3

Q: 2

Constant: NaN

GARCH: {NaN NaN NaN} at lags [1 2 3]

ARCH: {NaN NaN} at lags [1 2]

Leverage: {NaN NaN} at lags [1 2]

Offset: 0

Mdl is an egarch model object. All properties of Mdl, except P, Q, and Distribution, are NaN values. By default, the software:

Includes a conditional variance model constant

Excludes a conditional mean model offset (i.e., the offset is

0)Includes all lag terms in the GARCH polynomial up to lag

PIncludes all lag terms in the ARCH and leverage polynomials up to lag

Q

Mdl specifies only the functional form of an EGARCH model. Because it contains unknown parameter values, you can pass Mdl and time-series data to estimate to estimate the parameters.

Create an egarch model object using name-value pair arguments.

Specify an EGARCH(1,1) model. By default, the conditional mean model offset is zero. Specify that the offset is NaN. Include a leverage term.

Mdl = egarch('GARCHLags',1,'ARCHLags',1,'LeverageLags',1,'Offset',NaN)

Mdl =

egarch with properties:

Description: "EGARCH(1,1) Conditional Variance Model with Offset (Gaussian Distribution)"

SeriesName: "Y"

Distribution: Name = "Gaussian"

P: 1

Q: 1

Constant: NaN

GARCH: {NaN} at lag [1]

ARCH: {NaN} at lag [1]

Leverage: {NaN} at lag [1]

Offset: NaN

Mdl is an egarch model object. The software sets all parameters to NaN, except P, Q, and Distribution.

Since Mdl contains NaN values, Mdl is appropriate for estimation only. Pass Mdl and time-series data to estimate.

Create an EGARCH(1,1) model with mean offset,

where

and is an independent and identically distributed standard Gaussian process.

Mdl = egarch('Constant',0.0001,'GARCH',0.75,... 'ARCH',0.1,'Offset',0.5,'Leverage',{-0.3 0 0.01})

Mdl =

egarch with properties:

Description: "EGARCH(1,3) Conditional Variance Model with Offset (Gaussian Distribution)"

SeriesName: "Y"

Distribution: Name = "Gaussian"

P: 1

Q: 3

Constant: 0.0001

GARCH: {0.75} at lag [1]

ARCH: {0.1} at lag [1]

Leverage: {-0.3 0.01} at lags [1 3]

Offset: 0.5

egarch assigns default values to any properties you do not specify with name-value pair arguments. An alternative way to specify the leverage component is 'Leverage',{-0.3 0.01},'LeverageLags',[1 3].

Access the properties of a created egarch model object using dot notation.

Create an egarch model object.

Mdl = egarch(3,2)

Mdl =

egarch with properties:

Description: "EGARCH(3,2) Conditional Variance Model (Gaussian Distribution)"

SeriesName: "Y"

Distribution: Name = "Gaussian"

P: 3

Q: 2

Constant: NaN

GARCH: {NaN NaN NaN} at lags [1 2 3]

ARCH: {NaN NaN} at lags [1 2]

Leverage: {NaN NaN} at lags [1 2]

Offset: 0

Remove the second GARCH term from the model. That is, specify that the GARCH coefficient of the second lagged conditional variance is 0.

Mdl.GARCH{2} = 0Mdl =

egarch with properties:

Description: "EGARCH(3,2) Conditional Variance Model (Gaussian Distribution)"

SeriesName: "Y"

Distribution: Name = "Gaussian"

P: 3

Q: 2

Constant: NaN

GARCH: {NaN NaN} at lags [1 3]

ARCH: {NaN NaN} at lags [1 2]

Leverage: {NaN NaN} at lags [1 2]

Offset: 0

The GARCH polynomial has two unknown parameters corresponding to lags 1 and 3.

Display the distribution of the disturbances.

Mdl.Distribution

ans = struct with fields:

Name: "Gaussian"

The disturbances are Gaussian with mean 0 and variance 1.

Specify that the underlying disturbances have a t distribution with five degrees of freedom.

Mdl.Distribution = struct('Name','t','DoF',5)

Mdl =

egarch with properties:

Description: "EGARCH(3,2) Conditional Variance Model (t Distribution)"

SeriesName: "Y"

Distribution: Name = "t", DoF = 5

P: 3

Q: 2

Constant: NaN

GARCH: {NaN NaN} at lags [1 3]

ARCH: {NaN NaN} at lags [1 2]

Leverage: {NaN NaN} at lags [1 2]

Offset: 0

Specify that the ARCH coefficients are 0.2 for the first lag and 0.1 for the second lag.

Mdl.ARCH = {0.2 0.1}Mdl =

egarch with properties:

Description: "EGARCH(3,2) Conditional Variance Model (t Distribution)"

SeriesName: "Y"

Distribution: Name = "t", DoF = 5

P: 3

Q: 2

Constant: NaN

GARCH: {NaN NaN} at lags [1 3]

ARCH: {0.2 0.1} at lags [1 2]

Leverage: {NaN NaN} at lags [1 2]

Offset: 0

To estimate the remaining parameters, you can pass Mdl and your data to estimate and use the specified parameters as equality constraints. Or, you can specify the rest of the parameter values, and then simulate or forecast conditional variances from the GARCH model by passing the fully specified model to simulate or forecast, respectively.

Fit an EGARCH model to an annual time series of Danish nominal stock returns from 1922-1999.

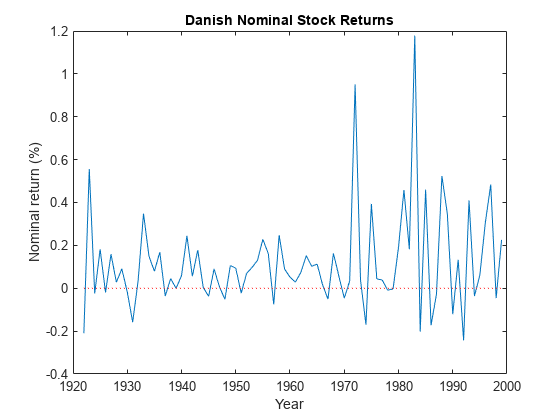

Load the Data_Danish data set. Plot the nominal returns (RN).

load Data_Danish; nr = DataTable.RN; figure; plot(dates,nr); hold on; plot([dates(1) dates(end)],[0 0],'r:'); % Plot y = 0 hold off; title('Danish Nominal Stock Returns'); ylabel('Nominal return (%)'); xlabel('Year');

The nominal return series seems to have a nonzero conditional mean offset and seems to exhibit volatility clustering. That is, the variability is smaller for earlier years than it is for later years. For this example, assume that an EGARCH(1,1) model is appropriate for this series.

Create an EGARCH(1,1) model. The conditional mean offset is zero by default. To estimate the offset, specify that it is NaN. Include a leverage lag.

Mdl = egarch('GARCHLags',1,'ARCHLags',1,'LeverageLags',1,'Offset',NaN);

Fit the EGARCH(1,1) model to the data.

EstMdl = estimate(Mdl,nr);

EGARCH(1,1) Conditional Variance Model with Offset (Gaussian Distribution):

Value StandardError TStatistic PValue

_________ _____________ __________ _________

Constant -0.62723 0.74401 -0.84304 0.3992

GARCH{1} 0.77419 0.23628 3.2766 0.0010507

ARCH{1} 0.38636 0.37361 1.0341 0.30107

Leverage{1} -0.002499 0.19222 -0.013001 0.98963

Offset 0.10325 0.037727 2.7368 0.0062047

EstMdl is a fully specified egarch model object. That is, it does not contain NaN values. You can assess the adequacy of the model by generating residuals using infer, and then analyzing them.

To simulate conditional variances or responses, pass EstMdl to simulate.

To forecast innovations, pass EstMdl to forecast.

Simulate conditional variance or response paths from a fully specified egarch model object. That is, simulate from an estimated egarch model or a known egarch model in which you specify all parameter values.

Load the Data_Danish data set.

load Data_Danish;

rn = DataTable.RN;Create an EGARCH(1,1) model with an unknown conditional mean offset. Fit the model to the annual, nominal return series. Include a leverage term.

Mdl = egarch('GARCHLags',1,'ARCHLags',1,'LeverageLags',1,'Offset',NaN); EstMdl = estimate(Mdl,rn);

EGARCH(1,1) Conditional Variance Model with Offset (Gaussian Distribution):

Value StandardError TStatistic PValue

_________ _____________ __________ _________

Constant -0.62723 0.74401 -0.84304 0.3992

GARCH{1} 0.77419 0.23628 3.2766 0.0010507

ARCH{1} 0.38636 0.37361 1.0341 0.30107

Leverage{1} -0.002499 0.19222 -0.013001 0.98963

Offset 0.10325 0.037727 2.7368 0.0062047

Simulate 100 paths of conditional variances and responses from the estimated EGARCH model.

numObs = numel(rn); % Sample size (T) numPaths = 100; % Number of paths to simulate rng(1); % For reproducibility [VSim,YSim] = simulate(EstMdl,numObs,'NumPaths',numPaths);

VSim and YSim are T-by- numPaths matrices. Rows correspond to a sample period, and columns correspond to a simulated path.

Plot the average and the 97.5% and 2.5% percentiles of the simulate paths. Compare the simulation statistics to the original data.

VSimBar = mean(VSim,2); VSimCI = quantile(VSim,[0.025 0.975],2); YSimBar = mean(YSim,2); YSimCI = quantile(YSim,[0.025 0.975],2); figure; subplot(2,1,1); h1 = plot(dates,VSim,'Color',0.8*ones(1,3)); hold on; h2 = plot(dates,VSimBar,'k--','LineWidth',2); h3 = plot(dates,VSimCI,'r--','LineWidth',2); hold off; title('Simulated Conditional Variances'); ylabel('Cond. var.'); xlabel('Year'); subplot(2,1,2); h1 = plot(dates,YSim,'Color',0.8*ones(1,3)); hold on; h2 = plot(dates,YSimBar,'k--','LineWidth',2); h3 = plot(dates,YSimCI,'r--','LineWidth',2); hold off; title('Simulated Nominal Returns'); ylabel('Nominal return (%)'); xlabel('Year'); legend([h1(1) h2 h3(1)],{'Simulated path' 'Mean' 'Confidence bounds'},... 'FontSize',7,'Location','NorthWest');

Forecast conditional variances from a fully specified egarch model object. That is, forecast from an estimated egarch model or a known egarch model in which you specify all parameter values. The example follows from Estimate EGARCH Model.

Load the Data_Danish data set.

load Data_Danish;

nr = DataTable.RN;Create an EGARCH(1,1) model with an unknown conditional mean offset and include a leverage term. Fit the model to the annual nominal return series.

Mdl = egarch('GARCHLags',1,'ARCHLags',1,'LeverageLags',1,'Offset',NaN); EstMdl = estimate(Mdl,nr);

EGARCH(1,1) Conditional Variance Model with Offset (Gaussian Distribution):

Value StandardError TStatistic PValue

_________ _____________ __________ _________

Constant -0.62723 0.74401 -0.84304 0.3992

GARCH{1} 0.77419 0.23628 3.2766 0.0010507

ARCH{1} 0.38636 0.37361 1.0341 0.30107

Leverage{1} -0.002499 0.19222 -0.013001 0.98963

Offset 0.10325 0.037727 2.7368 0.0062047

Forecast the conditional variance of the nominal return series 10 years into the future using the estimated EGARCH model. Specify the entire returns series as presample observations. The software infers presample conditional variances using the presample observations and the model.

numPeriods = 10; vF = forecast(EstMdl,numPeriods,nr);

Plot the forecasted conditional variances of the nominal returns. Compare the forecasts to the observed conditional variances.

v = infer(EstMdl,nr); figure; plot(dates,v,'k:','LineWidth',2); hold on; plot(dates(end):dates(end) + 10,[v(end);vF],'r','LineWidth',2); title('Forecasted Conditional Variances of Nominal Returns'); ylabel('Conditional variances'); xlabel('Year'); legend({'Estimation sample cond. var.','Forecasted cond. var.'},... 'Location','Best');

More About

An EGARCH model is a dynamic model that addresses conditional heteroscedasticity, or volatility clustering, in an innovations process. Volatility clustering occurs when an innovations process does not exhibit significant autocorrelation, but the variance of the process changes with time.

An EGARCH model posits that the current conditional variance is the sum of these linear processes:

Past logged conditional variances (the GARCH component or polynomial)

Magnitudes of past standardized innovations (the ARCH component or polynomial)

Past standardized innovations (the leverage component or polynomial)

Consider the time series

where The EGARCH(P,Q) conditional variance process, , has the form

The table shows how the variables correspond to the properties of the egarch object.

| Variable | Description | Property |

|---|---|---|

| μ | Innovation mean model constant offset | 'Offset' |

| κ | Conditional variance model constant | 'Constant' |

| γj | GARCH component coefficients | 'GARCH' |

| αj | ARCH component coefficients | 'ARCH' |

| ξj | Leverage component coefficients | 'Leverage' |

| zt | Series of independent random variables with mean 0 and variance 1 | 'Distribution' |

If zt is Gaussian, then

If zt is t distributed with ν > 2 degrees of freedom, then

To ensure a stationary EGARCH model, all roots of the GARCH lag operator polynomial, , must lie outside of the unit circle.

The EGARCH model is unique from the GARCH and GJR models because it models the logarithm of the variance. By modeling the logarithm, positivity constraints on the model parameters are relaxed. However, forecasts of conditional variances from an EGARCH model are biased, because by Jensen’s inequality,

EGARCH models are appropriate when positive and negative shocks of equal magnitude do not contribute equally to volatility [1].

Tips

You can specify an

egarchmodel as part of a composition of conditional mean and variance models. For details, seearima.An EGARCH(1,1) specification is complex enough for most applications. Typically in these models, the GARCH and ARCH coefficients are positive, and the leverage coefficients are negative. If you get these signs, then large unanticipated downward shocks increase the variance. If you get signs opposite to those signs that are expected, you can encounter difficulties inferring volatility sequences and forecasting. A negative ARCH coefficient is problematic. In this case, an EGARCH model might not be the best choice for your application.

References

[1] Tsay, R. S. Analysis of Financial Time Series. 3rd ed. Hoboken, NJ: John Wiley & Sons, Inc., 2010.

Version History

Introduced in R2012aYou can name the response series of an EGARCH model by setting the

SeriesName property of the associated model to a string

scalar. When you supply input response data to model object functions in a table or

timetable, the functions choose the variable with name SeriesName

as the response variable by default.

Describe an EGARCH model by setting the Description property

to a string scalar.

The indices of cell arrays of lag operator polynomial coefficients follow MATLAB cell array indexing rules.

Affected model properties are GARCH, ARCH, and

Leverage properties.

You cannot access any lag-zero coefficients by using an index of

0. For example,Mdl.ARCH{0}issues an error.Remove any instances of such indices of zero from your code. The value of all lag-zero coefficients is

1except for the lag operator polynomial corresponding to theARCHproperty, which has the value0.You cannot index beyond the maximal lag in the polynomial. For example, if

Mdl.Pis 4, thenMdl.ARCH{p}issues an error whenpis greater than4. For details on the maximal lags of the lag operator polynomials, see the corresponding property descriptions.Remove any instances of such indices beyond the maximal lag from your code. All coefficients beyond the maximal lag are

0.

The Name field of the Distribution property of

egarch model objects stores the innovation distribution name

as a string scalar, for example, "Gaussian" for Gaussian innovations.

Before R2018a, MATLAB stored the innovation distribution name as a character vector, for example

'Gaussian' for Gaussian innovations. Although most text-data

operations accept character vectors and string scalars for text-data input, the two data

types have some differences. For details, see Text in String and Character Arrays.

See Also

Objects

Topics

MATLAB Command

You clicked a link that corresponds to this MATLAB command:

Run the command by entering it in the MATLAB Command Window. Web browsers do not support MATLAB commands.

Website auswählen

Wählen Sie eine Website aus, um übersetzte Inhalte (sofern verfügbar) sowie lokale Veranstaltungen und Angebote anzuzeigen. Auf der Grundlage Ihres Standorts empfehlen wir Ihnen die folgende Auswahl: .

Sie können auch eine Website aus der folgenden Liste auswählen:

So erhalten Sie die bestmögliche Leistung auf der Website

Wählen Sie für die bestmögliche Website-Leistung die Website für China (auf Chinesisch oder Englisch). Andere landesspezifische Websites von MathWorks sind für Besuche von Ihrem Standort aus nicht optimiert.

Amerika

- América Latina (Español)

- Canada (English)

- United States (English)

Europa

- Belgium (English)

- Denmark (English)

- Deutschland (Deutsch)

- España (Español)

- Finland (English)

- France (Français)

- Ireland (English)

- Italia (Italiano)

- Luxembourg (English)

- Netherlands (English)

- Norway (English)

- Österreich (Deutsch)

- Portugal (English)

- Sweden (English)

- Switzerland

- United Kingdom (English)