forecast

Forecast sample paths from Markov-switching dynamic regression model

Syntax

Description

YF = forecast(Mdl,Y,numPeriods)YF of a fully specified Markov-switching dynamic regression model Mdl over a forecast horizon of length numPeriods. The forecasted responses represent the continuation of the response data Y.

YF = forecast(Mdl,Y,numPeriods,Name,Value)'X',X specifies exogenous data in the forecast horizon to evaluate regression components in the model.

Examples

Forecast a response path from a two-state Markov-switching dynamic regression model for a 1-D response process. This example uses arbitrary parameter values for the data-generating process (DGP).

Create Fully Specified Model for DGP

Create a two-state discrete-time Markov chain model that describes the regime switching mechanism. Label the regimes.

P = [0.9 0.1; 0.3 0.7]; mc = dtmc(P,'StateNames',["Expansion" "Recession"]);

mc is a fully specified dtmc object.

For each regime, use arima to create an AR model that describes the response process within the regime. Store the submodels in a vector.

mdl1 = arima('Constant',5,'AR',[0.3 0.2],... 'Variance',2); mdl2 = arima('Constant',-5,'AR',0.1,... 'Variance',1); mdl = [mdl1; mdl2];

mdl1 and mdl2 are fully specified arima objects.

Create a Markov-switching dynamic regression model from the switching mechanism mc and the vector of submodels mdl.

Mdl = msVAR(mc,mdl);

Mdl is a fully specified msVAR object.

Simulate Response Data from DGP

forecast requires enough data before the forecast horizon to initialize the model. Simulate 120 observations from the DGP.

rng(1); % For reproducibility

y = simulate(Mdl,120);y is a 120-by-1 random path of responses.

Compute Optimal Point Forecasts

Treat the first 100 observations of the simulated response data as the presample for the forecast, and treat the last 20 observations as a holdout sample.

idx0 = 1:100; idx1 = 101:120; y0 = y(idx0); y1 = y(idx1);

Compute 1- through 20-step-ahead optimal point forecasts from the model.

yf = forecast(Mdl,y0,20);

yf is a 20-by-1 vector of optimal point forecasts.

Plot the simulated response data and forecasts.

figure hold on plot(idx0,y0,'b'); h = plot(idx1,y1,'b--'); h1 = plot(idx1,yf,'r'); yfill = [ylim fliplr(ylim)]; xfill = [idx0(end) idx0(end) idx1(end) idx1(end)]; fill(xfill,yfill,'k','FaceAlpha',0.05) legend([h h1],["Actual" "Optimal"],'Location','NorthWest') title('Forecasts') hold off

Consider the model in Compute Optimal Point Forecasts.

Create Fully Specified Model for DGP

Create the fully specified Markov-switching dynamic regression model.

P = [0.9 0.1; 0.3 0.7]; mc = dtmc(P,'StateNames',["Expansion" "Recession"]); mdl1 = arima('Constant',5,'AR',[0.3 0.2],... 'Variance',2); mdl2 = arima('Constant',-5,'AR',0.1,... 'Variance',1); mdl = [mdl1; mdl2]; Mdl = msVAR(mc,mdl);

Simulate Response Data from DGP

forecast requires enough data before the forecast horizon to initialize the model. Simulate 120 observations from the DGP.

rng(10); % For reproducibility

y = simulate(Mdl,120);y is a 120-by-1 random path of responses.

Compute Monte Carlo Point Forecasts

Treat the first 100 observations of the simulated response data as the presample for the forecast, and treat the last 20 observations as a holdout sample.

idx0 = 1:100; idx1 = 101:120; y0 = y(idx0); y1 = y(idx1);

Compute 1- through 20-step-ahead optimal point forecasts from the model.

yf1 = forecast(Mdl,y0,20);

yf2 is a 20-by-1 vector of optimal point forecasts.

Compute 1- through 20-step-ahead Monte Carlo point forecasts by returning the estimated forecast error variances.

[yf2,estVar] = forecast(Mdl,y0,20);

yf2 is a 20-by-1 vector of Monte Carlo point forecasts. estVAR is a 20-by-1 vector of corresponding estimated forecast error variances.

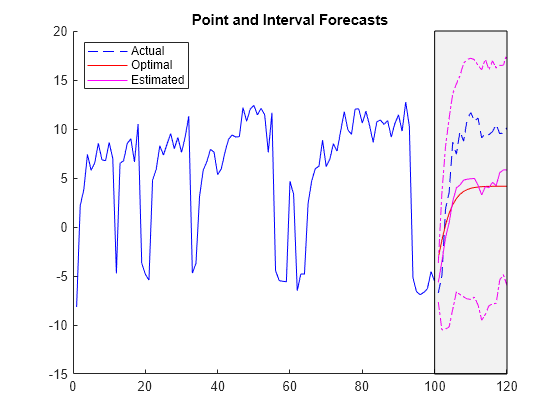

Plot the simulated response data, forecasts, and 95% forecast intervals using the Monte Carlo estimates.

figure hold on plot(idx0,y0,'b'); h = plot(idx1,y1,'b--'); h1 = plot(idx1,yf1,'r'); h2 = plot(idx1,yf2,'m'); ciu = yf2 + 1.96*sqrt(estVar); % Upper 95% confidence level cil = yf2 - 1.96*sqrt(estVar); % Lower 95% confidence level plot(idx1,ciu,'m-.'); plot(idx1,cil,'m-.'); yfill = [ylim,fliplr(ylim)]; xfill = [idx0(end) idx0(end) idx1(end) idx1(end)]; fill(xfill,yfill,'k','FaceAlpha',0.05) legend([h h1 h2],["Actual" "Optimal" "Estimated"],... 'Location',"NorthWest") title("Point and Interval Forecasts") hold off

forecast estimates forecasts and corresponding forecast error variances by performing Monte Carlo simulation. You can adjust the number of paths to sample by specifying the 'NumPaths' name-value pair argument. Consider the model in Compute Optimal Point Forecasts.

Create the fully specified Markov-switching dynamic regression model.

P = [0.9 0.1; 0.3 0.7]; mc = dtmc(P,'StateNames',["Expansion" "Recession"]); mdl1 = arima('Constant',5,'AR',[0.3 0.2],... 'Variance',2); mdl2 = arima('Constant',-5,'AR',0.1,... 'Variance',1); mdl = [mdl1; mdl2]; Mdl = msVAR(mc,mdl);

Simulate 100 observations from the DGP.

rng(10); % For reproducibility

y = simulate(Mdl,100);Compute 1- through 20-step-ahead Monte Carlo point forecasts by returning the estimated forecast error variances. Specify 1000 sample paths for the Monte Carlo simulation. Treat the observations y as the presample for the forecast.

[yf,estVar] = forecast(Mdl,y,20,'NumPaths',1000);yf is a 20-by-1 vector of Monte Carlo point forecasts. estVAR is a 20-by-1 vector of corresponding estimated forecast error variances.

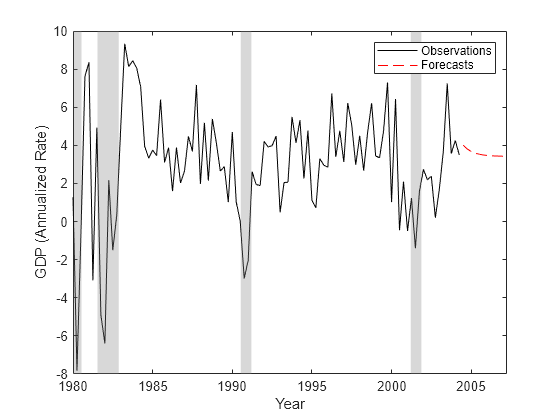

Consider a two-state Markov-switching dynamic regression model of the postwar US real GDP growth rate. The model has the parameter estimates presented in [1].

Create Markov-Switching Dynamic Regression Model

Create a fully specified discrete-time Markov chain model that describes the regime switching mechanism. Label the regimes.

P = [0.92 0.08; 0.26 0.74]; mc = dtmc(P,'StateNames',["Expansion" "Recession"]);

Create separate, fully specified AR(0) models for the two regimes.

sigma = 3.34; % Homoscedastic models across states mdl1 = arima('Constant',4.62,'Variance',sigma^2); mdl2 = arima('Constant',-0.48,'Variance',sigma^2); mdl = [mdl1 mdl2];

Create the Markov-switching dynamic regression model from the switching mechanism mc and the state-specific submodels mdl.

Mdl = msVAR(mc,mdl);

Mdl is a fully specified msVAR object.

Load and Preprocess Data

forecast requires observations to initialize the model. Load the US GDP data set.

load Data_GDPData contains quarterly measurements of the US real GDP in the period 1947:Q1–2005:Q2. The period of interest in [1] is 1947:Q2–2004:Q2. For more details on the data set, enter Description at the command line.

Transform the data to an annualized rate series by:

Converting the data to a quarterly rate within the estimation period

Annualizing the quarterly rates

qrate = diff(Data(2:230))./Data(2:229); % Quarterly rate arate = 100*((1 + qrate).^4 - 1); % Annualized rate

The transformation drops the first observation.

Forecast US GDP Rates

Forecast the model over a 12-quarter forecast horizon. Initialize the model by supplying the annualized rate series.

numPeriods = 12; yf = forecast(Mdl,arate,numPeriods);

yf is a 12-by-1 vector of model forecasts. yf(j) is the j-step-ahead optimal point forecast.

Plot the observed annualized GDP rate from 1980 with the model forecasts.

dates = datetime(dates(3:230),'ConvertFrom','datenum',... 'Format','yyyy:QQQ','Locale','en_US'); dt1980Q1 = datetime("1980:Q1",'InputFormat','yyyy:QQQ',... 'Locale','en_US'); % Specify US date format for 1980:Q1. idx = dates >= dt1980Q1; figure; plot(dates(idx),arate(idx),'k',... dates(end) + calquarters(1:numPeriods),yf,'r--') xlabel("Year") ylabel("GDP (Annualized Rate)") recessionplot legend("Observations","Forecasts")

Compute optimal and estimated forecasts and corresponding forecast error covariance matrices from a three-state Markov-switching dynamic regression model for a 2-D VARX response process. This example uses arbitrary parameter values for the DGP.

Create Fully Specified Model for DGP

Create a three-state discrete-time Markov chain model for the switching mechanism.

P = [10 1 1; 1 10 1; 1 1 10]; mc = dtmc(P);

mc is a fully specified dtmc object. dtmc normalizes the rows of P so that they sum to 1.

For each regime, use varm to create a VAR model that describes the response process within the regime. Specify all parameter values.

% Constants C1 = [1;-1]; C2 = [2;-2]; C3 = [3;-3]; % Autoregression coefficients AR1 = {}; AR2 = {[0.5 0.1; 0.5 0.5]}; AR3 = {[0.25 0; 0 0] [0 0; 0.25 0]}; % Regression coefficients Beta1 = [1;-1]; Beta2 = [2 2;-2 -2]; Beta3 = [3 3 3;-3 -3 -3]; % Innovations covariances Sigma1 = [1 -0.1; -0.1 1]; Sigma2 = [2 -0.2; -0.2 2]; Sigma3 = [3 -0.3; -0.3 3]; % VARX submodels mdl1 = varm('Constant',C1,'AR',AR1,'Beta',Beta1,'Covariance',Sigma1); mdl2 = varm('Constant',C2,'AR',AR2,'Beta',Beta2,'Covariance',Sigma2); mdl3 = varm('Constant',C3,'AR',AR3,'Beta',Beta3,'Covariance',Sigma3); mdl = [mdl1; mdl2; mdl3];

mdl contains three fully specified varm model objects.

For the DGP, create a fully specified Markov-switching dynamic regression model from the switching mechanism mc and the submodels mdl.

Mdl = msVAR(mc,mdl);

Mdl is a fully specified msVAR model.

Forecast Model Ignoring Regression Component

If you do not supply exogenous data, simulate and forecast ignore the regression components in the submodels. forecast requires enough data before the forecast horizon to initialize the model. Simulate 120 observations from the DGP.

rng('default'); % For reproducibility Y = simulate(Mdl,120);

Y is a 120-by-2 matrix of simulated responses. Rows correspond to time points, and columns correspond to variables in the system.

Treat the first 100 observations of the simulated response data as the presample for the forecast, and treat the last 20 observations as a holdout sample.

idx0 = 1:100; idx1 = 101:120; Y0 = Y(idx0,:); % Forecast sample Y1 = Y(idx1,:); % Holdout sample

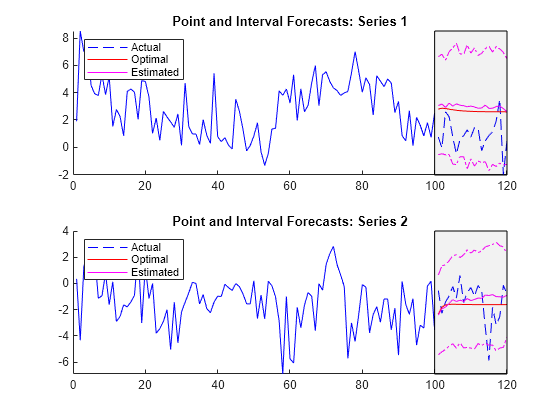

Compute 1- through 20-step-ahead optimal and estimated point forecasts from the model. Compute forecast error covariance matrices corresponding to the estimated forecasts.

YF1 = forecast(Mdl,Y0,20); [YF2,EstCov] = forecast(Mdl,Y0,20);

YF1 and YF2 are 20-by-2 matrices of optimal and estimated forecasts, respectively. EstCov is a 2-by-2-by-20 array of forecast error covariances.

Extract the forecast error variances of each response for each period in the forecast horizon.

estVar1(:) = EstCov(1,1,:); estVar2(:) = EstCov(2,2,:);

estVar1 and estVar2 are 1-by-20 vectors of forecast error variances.

Plot the data, forecasts, and 95% forecast intervals of each variable on separate subplots.

figure subplot(2,1,1) hold on plot(idx0,Y0(:,1),'b'); h = plot(idx1,Y1(:,1),'b--'); h1 = plot(idx1,YF1(:,1),'r'); h2 = plot(idx1,YF2(:,1),'m'); ciu = YF2(:,1) + 1.96*sqrt(estVar1'); % Upper 95% confidence level cil = YF2(:,1) - 1.96*sqrt(estVar1'); % Lower 95% confidence level plot(idx1,ciu,'m-.'); plot(idx1,cil,'m-.'); yfill = [ylim,fliplr(ylim)]; xfill = [idx0(end) idx0(end) idx1(end) idx1(end)]; fill(xfill,yfill,'k','FaceAlpha',0.05) legend([h h1 h2],["Actual" "Optimal" "Estimated"],... 'Location',"NorthWest") title("Point and Interval Forecasts: Series 1") hold off subplot(2,1,2) hold on plot(idx0,Y0(:,2),'b'); h = plot(idx1,Y1(:,2),'b--'); h1 = plot(idx1,YF1(:,2),'r'); h2 = plot(idx1,YF2(:,2),'m'); ciu = YF2(:,2) + 1.96*sqrt(estVar2'); % Upper 95% confidence level cil = YF2(:,2) - 1.96*sqrt(estVar2'); % Lower 95% confidence level plot(idx1,ciu,'m-.'); plot(idx1,cil,'m-.'); yfill = [ylim,fliplr(ylim)]; xfill = [idx0(end) idx0(end) idx1(end) idx1(end)]; fill(xfill,yfill,'k','FaceAlpha',0.05) legend([h h1 h2],["Actual" "Optimal" "Estimated"],... 'Location',"NorthWest") title("Point and Interval Forecasts: Series 2") hold off

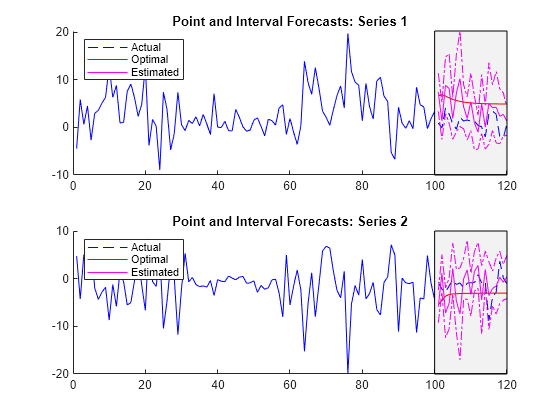

Forecast Model Including Regression Component

Simulate exogenous data for the three regressors by generating 120 random observations from the 3-D standard Gaussian distribution.

X = randn(120,3);

Simulate 120 observations from the DGP. Specify the exogenous data for the regression component.

rng('default') Y = simulate(Mdl,120,'X',X);

Treat the first 100 observations of the simulated response and exogenous data as the presample for the forecast, and treat the last 20 observations as a holdout sample.

idx0 = 1:100; idx1 = 101:120; Y0 = Y(idx0,:); Y1 = Y(idx1,:); X1 = X(idx1,:);

Compute 1- through 20-step-ahead optimal and estimated point forecasts from the model. Compute forecast error covariance matrices corresponding to the estimated forecasts. Specify the forecast-period exogenous data for the regression component.

YF1 = forecast(Mdl,Y0,20,'X',X1); [YF2,EstCov] = forecast(Mdl,Y0,20,'X',X1); estVar1(:) = EstCov(1,1,:); estVar2(:) = EstCov(2,2,:);

Plot the data, forecasts, and 95% forecast intervals of each variable on separate subplots.

figure subplot(2,1,1) hold on plot(idx0,Y0(:,1),'b'); h = plot(idx1,Y1(:,1),'b--'); h1 = plot(idx1,YF1(:,1),'r'); h2 = plot(idx1,YF2(:,1),'m'); ciu = YF2(:,1) + 1.96*sqrt(estVar1'); % Upper 95% confidence level cil = YF2(:,1) - 1.96*sqrt(estVar1'); % Lower 95% confidence level plot(idx1,ciu,'m-.'); plot(idx1,cil,'m-.'); yfill = [ylim,fliplr(ylim)]; xfill = [idx0(end) idx0(end) idx1(end) idx1(end)]; fill(xfill,yfill,'k','FaceAlpha',0.05) legend([h h1 h2],["Actual" "Optimal" "Estimated"],... 'Location',"NorthWest") title("Point and Interval Forecasts: Series 1") hold off subplot(2,1,2) hold on plot(idx0,Y0(:,2),'b'); h = plot(idx1,Y1(:,2),'b--'); h1 = plot(idx1,YF1(:,2),'r'); h2 = plot(idx1,YF2(:,2),'m'); ciu = YF2(:,2) + 1.96*sqrt(estVar2'); % Upper 95% confidence level cil = YF2(:,2) - 1.96*sqrt(estVar2'); % Lower 95% confidence level plot(idx1,ciu,'m-.'); plot(idx1,cil,'m-.'); yfill = [ylim,fliplr(ylim)]; xfill = [idx0(end) idx0(end) idx1(end) idx1(end)]; fill(xfill,yfill,'k','FaceAlpha',0.05) legend([h h1 h2],["Actual" "Optimal" "Estimated"],... 'Location',"NorthWest") title("Point and Interval Forecasts: Series 2") hold off

Input Arguments

Response data that provides initial values for the forecasts, specified as a numObs-by-numSeries numeric matrix.

numObs is the sample size. numSeries is the number of response variables (Mdl.NumSeries).

Rows correspond to observations, and the last row contains the latest observation. Columns correspond to individual response variables.

The forecasts YF represent the continuation of Y.

Data Types: double

Forecast horizon, or the number of time points in the forecast period, specified as a positive integer.

Data Types: double

Name-Value Arguments

Specify optional pairs of arguments as

Name1=Value1,...,NameN=ValueN, where Name is

the argument name and Value is the corresponding value.

Name-value arguments must appear after other arguments, but the order of the

pairs does not matter.

Before R2021a, use commas to separate each name and value, and enclose

Name in quotes.

Example: 'X',X uses the matrix X as exogenous data in the forecast horizon to evaluate regression components in the model.

Initial state probabilities from which to forecast, specified as the comma-separated pair consisting of 'S0' and a nonnegative numeric vector of length numStates. S0 corresponds to the end of the response data sample Y.

forecast normalizes S0 to produce a distribution.

By default, forecast applies smooth to Y using default settings, then sets S0 to the terminal distribution of states in the data.

Example: 'S0',[0.2 0.2 0.6]

Example: 'S0',[0 1] specifies state 2 as the initial state.

Data Types: double

Predictor data in the forecast horizon used to evaluate regression components in all submodels of Mdl, specified as the comma-separated pair consisting of 'X' and a numeric matrix or a cell vector of numeric matrices. The first row of X contains observations in the period after the period represented by the last observation in Y.

To use a subset of the same predictors in each state, specify X as a matrix with numPreds columns and at least numPeriods rows. Columns correspond to distinct predictor variables. Submodels use initial columns of the associated matrix, in order, up to the number of submodel predictors. The number of columns in the Beta property of Mdl.SubModels( determines the number of exogenous variables in the regression component of submodel j)jnumPeriods, then forecast uses the earliest observations.

To use different predictors in each state, specify a cell vector of such matrices with length numStates.

By default, forecast ignores the regression components in Mdl.

Data Types: double

Number of sample paths to generate for the simulation, specified as the comma-separated pair consisting of 'NumPaths' and a positive integer. If forecast returns only YF, it ignores NumPaths.

Example: 'NumPaths',1000

Data Types: double

Output Arguments

Point forecasts, returned as a numPeriods-by-numSeries numeric matrix.

If forecast returns only YF, then point forecasts are optimal. Otherwise, forecast uses Monte Carlo simulation to estimate the point forecasts.

Forecast error covariances, returned as a numeric column vector or numeric array.

If the submodels Mdl.SubModels represent univariate ARX models, EstCov is a numPeriods-by-1 vector. If Mdl.SubModels represent multivariate VARX models, EstCov is a numSeries-by-numSeries-by-numPeriods array.

forecast performs Monte Carlo simulation to compute EstCov.

Algorithms

Hamilton [2] provides a statistically optimal, one-step-ahead point forecast YF for a Markov-switching dynamic regression model. forecast computes YF iteratively to the forecast horizon when called with a single output. Nonlinearity of the Markov-switching dynamic regression model leads to nonnormal forecast errors, which complicate interval and density forecasts [3]. As a result, forecast switches to Monte Carlo methods when it returns EstCov.

References

[1] Chauvet, M., and J. D. Hamilton. "Dating Business Cycle Turning Points." In Nonlinear Analysis of Business Cycles (Contributions to Economic Analysis, Volume 276). (C. Milas, P. Rothman, and D. van Dijk, eds.). Amsterdam: Emerald Group Publishing Limited, 2006.

[2] Hamilton, J. D. "Analysis of Time Series Subject to Changes in Regime." Journal of Econometrics. Vol. 45, 1990, pp. 39–70.

[3] Krolzig, H.-M. Markov-Switching Vector Autoregressions. Berlin: Springer, 1997.

Version History

Introduced in R2019b

MATLAB Command

You clicked a link that corresponds to this MATLAB command:

Run the command by entering it in the MATLAB Command Window. Web browsers do not support MATLAB commands.

Website auswählen

Wählen Sie eine Website aus, um übersetzte Inhalte (sofern verfügbar) sowie lokale Veranstaltungen und Angebote anzuzeigen. Auf der Grundlage Ihres Standorts empfehlen wir Ihnen die folgende Auswahl: .

Sie können auch eine Website aus der folgenden Liste auswählen:

So erhalten Sie die bestmögliche Leistung auf der Website

Wählen Sie für die bestmögliche Website-Leistung die Website für China (auf Chinesisch oder Englisch). Andere landesspezifische Websites von MathWorks sind für Besuche von Ihrem Standort aus nicht optimiert.

Amerika

- América Latina (Español)

- Canada (English)

- United States (English)

Europa

- Belgium (English)

- Denmark (English)

- Deutschland (Deutsch)

- España (Español)

- Finland (English)

- France (Français)

- Ireland (English)

- Italia (Italiano)

- Luxembourg (English)

- Netherlands (English)

- Norway (English)

- Österreich (Deutsch)

- Portugal (English)

- Sweden (English)

- Switzerland

- United Kingdom (English)